INTERPOL Financial Fraud Report: The Global Threat Expands Boosted By Technology

Organized Crime Groups using more Human Trafficking Victims to carry out Crypto-Investment (‘pig-butchering’) and other Scams

Authors:

• SCARS Editorial Team – Society of Citizens Against Relationship Scams Inc.

• INTERPOL

About This Article

The recent INTERPOL assessment on global financial fraud underscores the growing threat posed by technology-enabled organized crime groups targeting victims worldwide.

Utilizing tools like Artificial Intelligence (AI), large language models, and cryptocurrencies, these groups orchestrate sophisticated fraud campaigns with minimal technical skills and at low costs. Secretary General Jürgen Stock warns of the epidemic scale of financial fraud, emphasizing the need for urgent action and enhanced information sharing.

The report reveals prevalent fraud trends such as investment fraud and romance fraud, necessitating multi-stakeholder partnerships to develop effective counter strategies. With financial fraud increasingly perpetrated by transnational networks, law enforcement faces the challenge of strengthening data collection and analysis to combat this escalating crime.

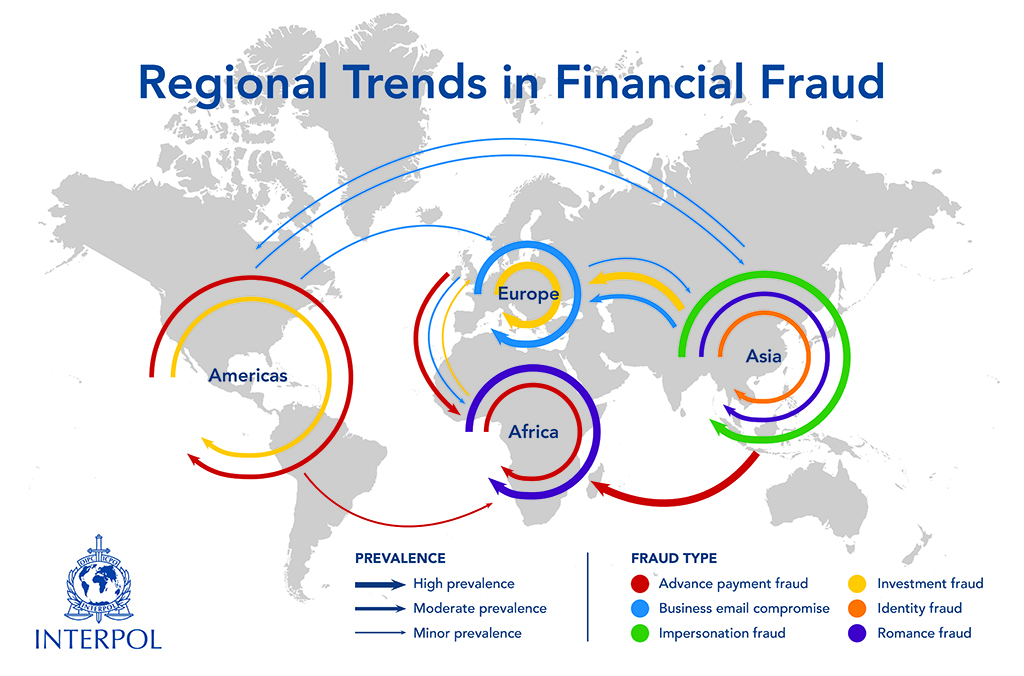

Regional trends highlight the pervasive nature of financial fraud, from Africa to the Americas, Asia, and Europe, necessitating a coordinated global response to safeguard individuals, businesses, and governments against this evolving threat.

A new INTERPOL assessment on global financial fraud highlights how the increased use of technology is enabling organized crime groups to better target victims around the world

The Interpol report and assessment show that the use of Artificial Intelligence (AI), large language models, and cryptocurrencies combined with phishing- and ransomware-as-a-service business models have resulted in more sophisticated and professional fraud campaigns without the need for advanced technical skills, and at relatively little cost.

SCARS Introduction

With the rapid advancement of technology, according to INTERPOL, financial fraud has evolved into a global epidemic, as highlighted by the recent INTERPOL assessment below.

Organized crime groups are leveraging sophisticated techniques, including Artificial Intelligence (AI), large language models, and cryptocurrencies, to orchestrate increasingly professional and widespread fraud campaigns. The emergence of AI and cryptocurrencies has lowered the barrier to entry for criminals, enabling them to conduct fraudulent activities with minimal technical expertise and at a relatively low cost.

The INTERPOL Secretary General, Jürgen Stock, warns of the urgent need for action to combat this growing threat, emphasizing the importance of closing existing gaps and promoting information sharing between sectors and across borders. The report, introduced at the Financial Fraud Summit in London, unveils key findings, including prevalent fraud trends such as investment fraud, romance fraud, and business email compromise.

To address these challenges effectively, the report calls for the establishment of multi-stakeholder Public-Private Partnerships and emphasizes the critical role of enhanced data collection and analysis in developing informed counter strategies. Regional trends reveal the pervasive nature of financial fraud across continents, from Africa to the Americas, Asia, and Europe, underscoring the need for a coordinated and collaborative approach to combat this global menace.

INTERPOL 2024 Assessment

Analysis behind the INTERPOL Global Financial Fraud Assessment also points to the global expansion of human trafficking for the purpose of forced criminality in call centres, particularly to carry out ‘pig-butchering’ scams – a hybrid scheme combining romance and investment frauds, using cryptocurrencies.

INTERPOL Secretary General Jürgen Stock said:

“We are facing an epidemic in the growth of financial fraud, leading to individuals, often vulnerable people, and companies being defrauded on a massive and global scale.

“Changes in technology and the rapid increase in the scale and volume of organized crime has driven the creation of a range of new ways to defraud innocent people, business and even governments. With the development of AI and Cryptocurrencies, the situation is only going to get worse without urgent action.

“It is important that there are no safe havens for financial fraudsters to operate. We must close existing gaps and ensure information sharing between sectors and across borders is the norm, not the exception.

“We also need to encourage greater reporting of financial crime as well as invest in capacity building and training for law enforcement to develop a more effective and truly global response.”

The report is being launched by the Secretary General at the Financial Fraud Summit, organized by the UK government in London.

Key Findings

Other key findings of the report, which is for law enforcement use only, include:

- The most prevalent global trends are investment fraud, advance payment fraud, romance fraud and business email compromise

- Financial fraud is most often carried out by a network of co-offenders, varying from highly structured to loosely affiliated.

- An urgent need to strengthen data collection and analysis in order to develop more informed and effective counter strategies.

To effectively address this globally escalating crime and bridge crucial information gaps, one of the report’s recommendations is the need to build multi-stakeholder, Public-Private Partnerships to trace and recover funds lost to financial fraud.

Since the launch of INTERPOL’s Global Rapid Intervention of Payments (I-GRIP) stop-payment mechanism in 2022, the Organization has helped member countries intercept more than USD 500 million in criminal proceeds, stemming largely from cyber-enabled fraud.

Regional Trends in Financial Fraud

Africa

Business Email Compromise remains one of the most prevalent trends in Africa, however there is increasing use of the pig butchering fraud. Cases of this fraud type have been identified in West and Southern Africa targeting victims in other jurisdictions beyond the continent.

Certain West African criminal groups, including the Black Axe, Airlords and Supreme Eiye, continue to grow transnationally, and are known to have extensive skills in online financial fraud such as romance fraud, investment fraud, advance fee fraud, and cryptocurrency fraud.

Americas

The most common types of fraud across the Americas are impersonation, romance, tech support, advance payment, and telecom frauds.

Human trafficking-fuelled fraud continues to be a growing crime phenomenon. The INTERPOL coordinated operation, Operation Turquesa V, revealed that hundreds of victims were trafficked out of the region after being lured via messaging apps and social media platforms and coerced to commit fraud, including investments frauds and pig butchering.

There is emerging evidence that Latin-American crime syndicates such as Commando Vermelho, Primeiro Comando da Capital (PCC) and Cartel Jalisco New Generation (CJNG) are also involved in the commission of financial fraud.

Asia

Pig butchering fraud schemes initiated in Asia in 2019, and expanded during the COVID-19 pandemic. Subsequently, Asia has emerged as a focal point, with criminal organizations in poorer countries across the region employing business-like structures.

Another fraud type that has experienced a surge in recent years in Asia is a type of telecommunication fraud where perpetrators impersonate law enforcement officers or bank officials to trick victims to disclose their credit card or bank account credentials or to hand over huge amounts of money.

Europe

Online investment frauds, phishing, and other online financial fraud schemes have escalated on carefully selected targets to maximize profits. Mobile phone apps are also being targeted by cybercriminals.

The criminal networks involved in these online schemes often display sophisticated and complex modi operandi, which are usually a combination of different fraud types.

Pig butchering, predominantly carried out of call centres in Southeast Asia, is also on the rise.

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

More Related Information:

- INTERPOL Warns Of ‘Metacrime’ On The Metaverse – 2024 (scamsnow.com)

- Interpol Operation Jackal – Arrested Over 100 (scamsnow.com)

- INTERPOL Operation HAECHI IV – Over 3,500 Successful Arrests – Expanded Details – 2023 (scamsnow.com)

- INTERPOL Issues Global Warning On Human Trafficking-Fueled Fraud (scamsnow.com)

- INTERPOL Identified Networks Linked to Financial Losses of More Than USD $40 Million (scamsnow.com)

- Major Ivory Coast Scammer Kingpin of OPERA1er Group Arrested (scamsnow.com)

- 16shop Phishing-As-A-Service Platform Taken Down (scamsnow.com)

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

SCARS LINKS: AgainstScams.org RomanceScamsNOW.com ContraEstafas.org ScammerPhotos.com Anyscam.com ScamsNOW.com

reporting.AgainstScams.org support.AgainstScams.org membership.AgainstScams.org donate.AgainstScams.org shop.AgainstScams.org

youtube.AgainstScams.org linkedin.AgainstScams.org facebook.AgainstScams.org

TABLE OF CONTENTS

- Organized Crime Groups using more Human Trafficking Victims to carry out Crypto-Investment (‘pig-butchering’) and other Scams

- About This Article

- A new INTERPOL assessment on global financial fraud highlights how the increased use of technology is enabling organized crime groups to better target victims around the world

- SCARS Introduction

- INTERPOL 2024 Assessment

- Key Findings

- Regional Trends in Financial Fraud

- More Related Information:

CATEGORIES

![NavyLogo@4x-81[1] INTERPOL Financial Fraud Report: The Global Threat Expands Boosted By Technology - 2024](https://scamsnow.com/wp-content/uploads/2025/04/NavyLogo@4x-811.png)

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims.

- SCARS Institute now offers its free, safe, and private Scam Survivor’s Support Community at www.SCARScommunity.org – this is not on a social media platform, it is our own safe & secure platform created by the SCARS Institute especially for scam victims & survivors.

- SCARS Institute now offers a free recovery learning program at www.SCARSeducation.org.

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery.

If you are looking for local trauma counselors, please visit counseling.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

Statement About Victim Blaming

Some of our articles discuss various aspects of victims. This is both about better understanding victims (the science of victimology) and their behaviors and psychology. This helps us to educate victims/survivors about why these crimes happened and not to blame themselves, better develop recovery programs, and help victims avoid scams in the future. At times, this may sound like blaming the victim, but it does not blame scam victims; we are simply explaining the hows and whys of the experience victims have.

These articles, about the Psychology of Scams or Victim Psychology – meaning that all humans have psychological or cognitive characteristics in common that can either be exploited or work against us – help us all to understand the unique challenges victims face before, during, and after scams, fraud, or cybercrimes. These sometimes talk about some of the vulnerabilities the scammers exploit. Victims rarely have control of them or are even aware of them, until something like a scam happens, and then they can learn how their mind works and how to overcome these mechanisms.

Articles like these help victims and others understand these processes and how to help prevent them from being exploited again or to help them recover more easily by understanding their post-scam behaviors. Learn more about the Psychology of Scams at www.ScamPsychology.org

SCARS INSTITUTE RESOURCES:

If You Have Been Victimized By A Scam Or Cybercrime

♦ If you are a victim of scams, go to www.ScamVictimsSupport.org for real knowledge and help

♦ SCARS Institute now offers its free, safe, and private Scam Survivor’s Support Community at www.SCARScommunity.org/register – this is not on a social media platform, it is our own safe & secure platform created by the SCARS Institute especially for scam victims & survivors.

♦ Enroll in SCARS Scam Survivor’s School now at www.SCARSeducation.org

♦ To report criminals, visit https://reporting.AgainstScams.org – we will NEVER give your data to money recovery companies like some do!

♦ Follow us and find our podcasts, webinars, and helpful videos on YouTube: https://www.youtube.com/@RomancescamsNowcom

♦ Learn about the Psychology of Scams at www.ScamPsychology.org

♦ Dig deeper into the reality of scams, fraud, and cybercrime at www.ScamsNOW.com and www.RomanceScamsNOW.com

♦ Scam Survivor’s Stories: www.ScamSurvivorStories.org

♦ For Scam Victim Advocates visit www.ScamVictimsAdvocates.org

♦ See more scammer photos on www.ScammerPhotos.com

You can also find the SCARS Institute’s knowledge and information on Facebook, Instagram, X, LinkedIn, and TruthSocial

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this and other SCARS articles are intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

Note about Mindfulness: Mindfulness practices have the potential to create psychological distress for some individuals. Please consult a mental health professional or experienced meditation instructor for guidance should you encounter difficulties.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here

If you are in crisis, feeling desperate, or in despair, please call 988 or your local crisis hotline – international numbers here.

More ScamsNOW.com Articles

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish. Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors’ experience. You can do Google searches, but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

![scars-institute[1] INTERPOL Financial Fraud Report: The Global Threat Expands Boosted By Technology - 2024](https://scamsnow.com/wp-content/uploads/2025/04/scars-institute1.png)

![niprc1.png1_-150×1501-1[1] INTERPOL Financial Fraud Report: The Global Threat Expands Boosted By Technology - 2024](https://scamsnow.com/wp-content/uploads/2025/04/niprc1.png1_-150x1501-11.webp)