Scams and Cryptocurrency go Hand in Hand

Authors:

• Yaniv Hanoch, Associate Professor in Risk Management, University of Southampton; and

• Stacey Wood, Professor of Psychology, Scripps College

Scams And Cryptocurrency Can Go Hand In Hand – Here’s How They Work And What To Watch Out For

When one of our students told us they were going to drop out of college in August 2021, it wasn’t the first time we’d heard of someone ending their studies prematurely. What was new, though, was the reason. The student had become a victim of a cryptocurrency scam and had lost all their money – including a bank loan – leaving them not just broke, but in debt. The experience was financially and psychologically traumatic, to say the least.

This Student, Unfortunately, Is Not Alone

Currently, there are hundreds of millions of cryptocurrency owners, with estimates predicting further rapid growth. As the number of people owning cryptocurrencies has increased, so has the number of scam victims.

We study behavioral economics and psychology – and recently published a book about the rising problem of fraud, scams and financial abuse. There are reasons why cryptocurrency scams are so prevalent. And there are steps you can take to reduce your chances of becoming a victim.

Crypto Takes Off

Scams are not a recent phenomenon, with stories about them dating back to biblical times. What has fundamentally changed is the ease by which scammers can reach millions, if not billions, of individuals with a press of a button. The internet and other technologies have simply changed the rules of the game, with cryptocurrencies coming to epitomize the leading edge of these new cybercrime opportunities.

Cryptocurrencies – which are decentralized, digital currencies that use cryptography to create anonymous transactions – were originally driven by “cypherpunks,” individuals concerned with privacy. But they have expanded to capture the minds and pockets of everyday people and criminals alike, especially during the COVID-19 pandemic, when the price of various cryptocurrencies shot up and cryptocurrencies became more mainstream. Scammers capitalized on their popularity. The pandemic also caused a disruption to mainstream business, leading to greater reliance on alternatives such as cryptocurrencies.

A January 2022 report by Chainanalysis, a blockchain data platform, suggests in 2021 close to US$14 billion was scammed from investors using cryptocurrencies.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

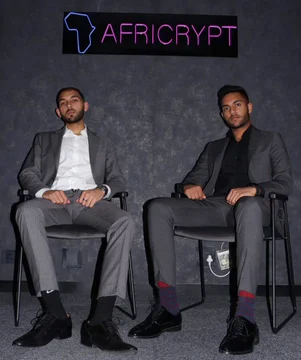

For example, in 2021, two brothers from South Africa managed to defraud investors of $3.6 billion from a cryptocurrency investment platform. In February 2022, the FBI announced it had arrested a couple who used a fake cryptocurrency platform to defraud investors of another $3.6 billion

You might wonder how they did it.

Fake Investments

There are two main types of cryptocurrency scams that tend to target different populations.

One targets cryptocurrency investors, who tend to be active traders holding risky portfolios. They are mostly younger investors, under 35, who earn high incomes, are well educated and work in engineering, finance or IT. In these types of frauds, scammers create fake coins or fake exchanges.

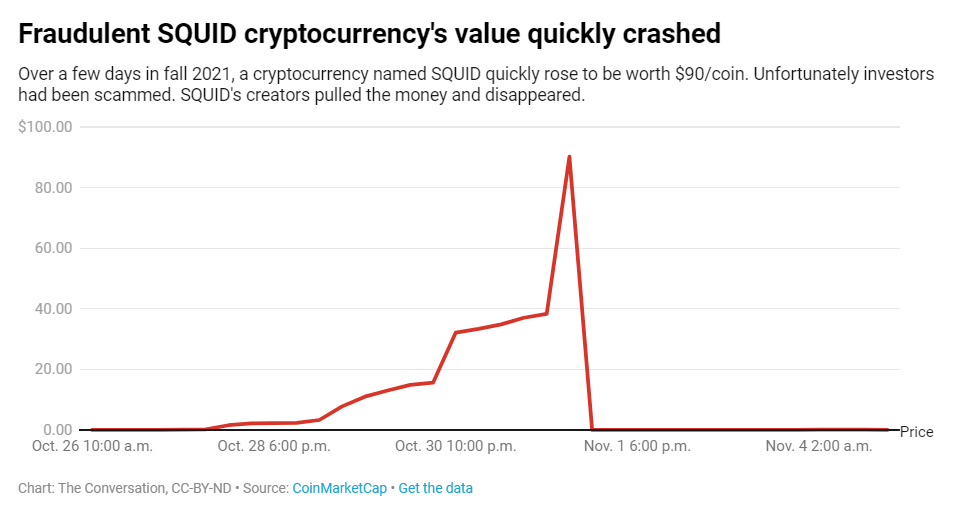

A recent example is SQUID, a cryptocurrency coin named after the TV drama “Squid Game.” After the new coin skyrocketed in price, its creators simply disappeared with the money.

A variation on this scam involves enticing investors to be among the first to purchase a new cryptocurrency – a process called an initial coin offering – with promises of large and fast returns. But unlike the SQUID offering, no coins are ever issued, and would-be investors are left empty-handed. In fact, many initial coin offerings turn out to be fake, but because of the complex and evolving nature of these new coins and technologies, even educated, experienced investors can be fooled.

As with all risky financial ventures, anyone considering buying cryptocurrency should follow the age-old advice to thoroughly research the offer. Who is behind the offering? What is known about the company? Is a white paper, an informational document issued by a company outlining the features of its product, available?

In the SQUID case, one warning sign was that investors who had bought the coins were unable to sell them. The SQUID website was also riddled with grammatical errors, which is typical of many scams.

Shakedown Payments

The second basic type of cryptocurrency scam simply uses cryptocurrency as the payment method to transfer funds from victims to scammers. All ages and demographics can be targets. These include ransomware cases, romance scams, computer repair scams, sextortion cases, Ponzi schemes and the like. Scammers are simply capitalizing on the anonymous nature of cryptocurrencies to hide their identities and evade consequences.

In the recent past, scammers would request wire transfers or gift cards to receive money – as they are irreversible, anonymous and untraceable. However, such payment methods do require potential victims to leave their homes, where they might encounter a third party who can intervene and possibly stop them. Crypto, on the other hand, can be purchased from anywhere at any time.

Indeed, Bitcoin has become the most common currency requested in ransomware cases, being demanded in close to 98% of cases. According to the U.K. National Cyber Security Center, sextortion scams often request individuals to pay in Bitcoin and other cryptocurrencies. Romance scams targeting younger adults are increasingly using cryptocurrency as part of the scam.

If someone is asking you to transfer money to them via cryptocurrency, you should see a giant red flag.

The Wild West

In the field of financial exploitation, more work has been done to study and educate elderly scam victims, because of the high levels of vulnerability in this group. Research has identified common traits that make someone especially vulnerable to scam solicitations. They include differences in cognitive ability, education, risk-taking and self-control.

Of course, younger adults can also be vulnerable and indeed are becoming victims, too. There is a clear need to broaden education campaigns to include all age groups, including young, educated, well-off investors. We believe authorities need to step up and employ new methods of protection. For example, the regulations that currently apply to financial advice and products could be extended to the cryptocurrency environment. Data scientists also need to better track and trace fraudulent activities.

Cryptocurrency scams are especially painful because the probability of retrieving lost funds is close to zero. For now, cryptocurrencies have no oversight. They are simply the Wild West of the financial world.

[SCARS NOTE: recovery of cryptocurrency is NOT close to zero, in fact, it is becoming increasingly common. Law enforcement regularly recovers cryptocurrency for scam victims now almost every day.]

More:

- 2023 BIG Cryptocurrency Investigator’s Handbook (romancescamsnow.com)

- A Fresh Look at Fraud: Theoretical and Applied Perspectives – 1st Edit (routledge.com)

- Fake COVID-19 Cryptocurrency Emerges Promising to Gain Value with Each Death (bitdefender.com)

- Sextortion emails: how to protect yourself – NCSC.GOV.UK

- The Scams Among Us: Who Falls Prey and Why – Yaniv Hanoch, Stacey Wood, 2021 (sagepub.com)

- Criminal Cryptocurrency Boss Jailed For 11,196 Years In Turkey For Fraud (scamsnow.com)

- Cryptocurrency Recovery Alert from the FBI (scamsnow.com)

- Cryptocurrency Home Invasion Armed Robbery (scamsnow.com)

- Israel Seized $1.7M in Crypto (scamsnow.com)

- North Korea Attacking The Crypto Ecosystem (romancescamsnow.com)

- Cryptocurrency Enforcement – The Report Of The U.S. Attorney General’s Cyber Digital Task Force (romancescamsnow.com)

- Reporting Scams To The United States Secret Service – Cryptocurrency Recovery – Forget The FBI! [VIDEO] (romancescamsnow.com)

This article was reprinted from The Conversation with permission

SCARS Resources:

- For New Victims of Relationship Scams newvictim.AgainstScams.org

- Subscribe to SCARS Newsletter newsletter.againstscams.org

- Sign up for SCARS professional support & recovery groups, visit support.AgainstScams.org

- Find competent trauma counselors or therapists, visit counseling.AgainstScams.org

- Become a SCARS Member and get free counseling benefits, visit membership.AgainstScams.org

- Report each and every crime, learn how to at reporting.AgainstScams.org

- Learn more about Scams & Scammers at RomanceScamsNOW.com and ScamsNOW.com

- Global Cyber Alliance ACT Cybersecurity Tool Website: Actionable Cybersecurity Tools (ACT) (globalcyberalliance.org)

- Self-Help Books for Scam Victims are at shop.AgainstScams.org

- Donate to SCARS and help us help others at donate.AgainstScams.org

- Worldwide Crisis Hotlines: International Suicide Hotlines – OpenCounseling : OpenCounseling

- Campaign To End Scam Victim Blaming – 2024 (scamsnow.com)

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

More ScamsNOW.com Articles

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment above!

SCARS LINKS: AgainstScams.org RomanceScamsNOW.com ContraEstafas.org ScammerPhotos.com Anyscam.com ScamsNOW.com

reporting.AgainstScams.org support.AgainstScams.org membership.AgainstScams.org donate.AgainstScams.org shop.AgainstScams.org

youtube.AgainstScams.org linkedin.AgainstScams.org facebook.AgainstScams.org

ARTICLE RATING

TABLE OF CONTENTS

CATEGORIES

MOST POPULAR COMMENTED ARTICLES

POPULAR ARTICLES

U.S. & Canada Suicide Lifeline 988

![NavyLogo@4x-81[1]](https://scamsnow.com/wp-content/uploads/2025/04/NavyLogo@4x-811.png)

ARTICLE META

WHAT PEOPLE ARE TALKING ABOUT LATEST SITE COMMENTS

See Comments for this Article at the Bottom of the Page

on Substance Abuse Susceptibility And Scam Victims – 2024: “It is understandable how some would feel that alcohol or substance abuse would be helpful in handling their feelings after…” Jul 1, 20:36

on Scam Victims Use Work To Avoid Healing: “The last 6 years have been the most difficult of my life. The pandemic, having both parents in the hospital…” Jun 29, 18:38

on Entitlement Mentality And How Scam Victims Often Lose Their Path To Recovery – 2024: “Thank you for this discussion of entitlement. I can see from the descriptions listed that I have not felt entitlement.…” Jun 29, 18:22

on Samurai Wisdom and Rituals for Clearing the Mind After Scam Trauma – 2025 – [VIDEOS]: “A great guide on how to move forward in our recovery process with a calm mind, cleansed on an ongoing…” Jun 28, 07:34

on Delayed Gratification and Patience in Scam Victim Recovery – 2025 – [VIDEOS]: “We want to recover quickly and… we make new mistakes. How not to speed up the recovery process, how to…” Jun 28, 06:41

on The Unique Injury Of Betrayal Trauma On Scam Victims – 2024: “Primarily because you did not see it coming” Jun 27, 23:57

on Changes In A Scam Victim’s Life: “I really detest the way my trust in others has been affected by the scamming I went through. I used…” Jun 27, 14:47

on The Unique Injury Of Betrayal Trauma On Scam Victims – 2024: “Betrayal Trauma is the worst feeling ever. Why does it seem so much worse when a scammer does that to…” Jun 27, 14:34

on EMDR Therapy For Scam Victims’ Trauma – A Part Of The Recovery Process For Many – 2024: “Very comprehensive article explaining all aspects of EMDR. I’d only heard of it before and now I have a much…” Jun 26, 19:01

on Forgiving Yourself After Surviving a Romance or Investment Scam – 2025: “Thank you for this valuable article. Self-forgiveness was for me the biggest step that led to my recovery. That also…” Jun 26, 17:28

on Counseling And Your Native Language: “These points make perfect sense. I can’t imagine trying to express complex emotions in a second language. I realize many…” Jun 26, 16:05

on Thought-Terminating Cliches – How What You and Others Say Stops Critical Thinking and Recovery for Scam Victims – 2025: “I didn’t realize that these “innocent phrases” clichés ending thoughts, can have such effect / negative -inhibiting / on our…” Jun 26, 14:48

on Scam Victim Resistance In Support Groups Therapy Or Counseling Can Destroy Opportunities For Recovery – 2024: “Working with either a support group or therapist to me means a self commitment to actively participating in the therapy.…” Jun 24, 21:01

on ‘I Just Want To Forget It’ – Denial & Avoidance Are Natural But Will Not Help Scam Victims On Their Path To Recovery From Scams – 2024: “My financial loss, the shock and betrayal of the crime ending all combined to fray my nerves and spend hours…” Jun 24, 20:10

on You Hate Being Told What To Do? How Your Rebellious Mentality Can Sabotage Your Recovery – 2025: “I am a bit of a rebel, and the moment someone tells me to do something, worse, does it even…” Jun 24, 15:04

on You Hate Being Told What To Do? How Your Rebellious Mentality Can Sabotage Your Recovery – 2025: “You are very welcome” Jun 24, 03:01

on You Hate Being Told What To Do? How Your Rebellious Mentality Can Sabotage Your Recovery – 2025: “This is a great article, which makes perfect sense as to why anyone would resist the help offered to them.…” Jun 23, 20:01

on Scam Victims’ Responsibilities – 2021 [Updated 2025]: “Thank you for this article. As I continue my journey, I focus on the here and now and let the…” Jun 21, 16:26

on Scam Victims Avoid Or Escape The Aftermath Of Scams – How Denial And Distraction Avoid Confronting Reality – 2024: “In the earliest days after my crime I felt powerless, helpless and weak. I had been through so much in…” Jun 21, 14:46

Important Information for New Scam Victims

Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

SCARS Institute now offers a free recovery program at www.SCARSeducation.org

Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors, please visit counseling.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

Statement About Victim Blaming

Some of our articles discuss various aspects of victims. This is both about better understanding victims (the science of victimology) and their behaviors and psychology. This helps us to educate victims/survivors about why these crimes happened and not to blame themselves, better develop recovery programs, and help victims avoid scams in the future. At times, this may sound like blaming the victim, but it does not blame scam victims; we are simply explaining the hows and whys of the experience victims have.

These articles, about the Psychology of Scams or Victim Psychology – meaning that all humans have psychological or cognitive characteristics in common that can either be exploited or work against us – help us all to understand the unique challenges victims face before, during, and after scams, fraud, or cybercrimes. These sometimes talk about some of the vulnerabilities the scammers exploit. Victims rarely have control of them or are even aware of them, until something like a scam happens, and then they can learn how their mind works and how to overcome these mechanisms.

Articles like these help victims and others understand these processes and how to help prevent them from being exploited again or to help them recover more easily by understanding their post-scam behaviors. Learn more about the Psychology of Scams at www.ScamPsychology.org

SCARS INSTITUTE RESOURCES:

If You Have Been Victimized By A Scam Or Cybercrime

♦ If you are a victim of scams, go to www.ScamVictimsSupport.org for real knowledge and help

♦ Enroll in SCARS Scam Survivor’s School now at www.SCARSeducation.org

♦ To report criminals, visit https://reporting.AgainstScams.org – we will NEVER give your data to money recovery companies like some do!

♦ Follow us and find our podcasts, webinars, and helpful videos on YouTube: https://www.youtube.com/@RomancescamsNowcom

♦ Learn about the Psychology of Scams at www.ScamPsychology.org

♦ Dig deeper into the reality of scams, fraud, and cybercrime at www.ScamsNOW.com and www.RomanceScamsNOW.com

♦ Scam Survivor’s Stories: www.ScamSurvivorStories.org

♦ For Scam Victim Advocates visit www.ScamVictimsAdvocates.org

♦ See more scammer photos on www.ScammerPhotos.com

You can also find the SCARS Institute on Facebook, Instagram, X, LinkedIn, and TruthSocial

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this and other SCARS articles are intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

Note about Mindfulness: Mindfulness practices have the potential to create psychological distress for some individuals. Please consult a mental health professional or experienced meditation instructor for guidance should you encounter difficulties.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here

If you are in crisis, feeling desperate, or in despair, please call 988 or your local crisis hotline.

More ScamsNOW.com Articles

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish. Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors’ experience. You can do Google searches, but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

![scars-institute[1]](https://scamsnow.com/wp-content/uploads/2025/04/scars-institute1.png)

![niprc1.png1_-150×1501-1[1]](https://scamsnow.com/wp-content/uploads/2025/04/niprc1.png1_-150x1501-11.webp)

Good article. I have a hard time understanding cryptocurrency. Toward the end of my romance crime it was suggested by the criminal to purchase Bitcoin instead of gift cards. The criminal had given me false information and asked me to make a claim that the last 3 gift cards purchased had been “drained” of funds. Which, of course they had! By the criminal! The criminal was making this big story about needing to secure their phone so that when their management team took it (which seemed to happen quite often) they would not have any worries that the management team would know that we were still communicating. The criminal moaned and groaned that they tried to get $2,000 from their “daughter”, the daughter had also tried to get some of the money but no one would help them, no friends, no loans, etc. The criminal insisted that since 3 gift cards had been drained that I had to replace them. Two were in process of refund by the gift card company. The last chunk of money the criminal tried to get me to send in Bitcoin and to create a wallet. All of it seemed like Greek to me. I resisted. The criminal pitched a huge fit and ranted for hours in text on Telegram. I had “woke up” a couple of weeks before so I largely ignored them. Their next trick when I wouldn’t participate in crypto was for me to do this very legal thing for them. They wanted me to get a business checking account. To do that all I had to do was register a limited liability corporation here in my state and then apply for a Federal Employer’s Identification Number which I would need to open the business checking. The criminal spent a lot of time trying to convince me to comply.

My PBS used a real platform hijacked on the back end. The information I was seeing in my trading account was faked. I only discovered the scam when I tried to make a withdrawal.