In Japan – Secondary Victimization by Law Firms

By Rika Takebe, Vice Director, NPO Charms – a Janaese Nonprofit Supporting Japanese Scam Victims [on Facebook]

In Japan, Law Firms “Specialized In The Romance Scams / Money Recovery” Come To The Top Of Search

In Japan, if you search “romance scams” (国際ロマンス詐欺) on Google in the Japanese language, the law offices claim to be specialized in online romance scams come to the top of the search. These law offices say they have successfully recovered the loss for the online romance scam victims.

This is becoming a secondary victimization in Japan.

Why Victims Go To Japanese Law Offices Instead Of Police

The recent arrest of the Japanese scammer in Ghana in 20221 and the arrest of local scammers involved in online fraud since 2019 indicate that the Japanese police do investigate and arrest online scammers, mostly Japanese nationals and foreigners who live in Japan.

However, scam victims in Japan are negative about reporting to the police.

The Japanese nonprofit organization of NPO CHARMS conducted a survey with 68 scam victims on multiple choice questions to ask about the reason why they did not report to the police in 2020.

There are several possible reasons victims in Japan prefer not to report to the police. 30% of the 68 respondents in the survey indicated fear of being known by family and friends or feeling ashamed of reporting. It was significant that 70% of respondents reasoned that police will never investigate their case. And if the victims reported to the police, the victims encounter negative responses. In the same survey, 43 respondents who reported to the police indicated that the police officer rejected their claim and was treated as a consultation only.

The negative experiences of those who reported to the police in Japan may possibly write about their bad experiences on social networks. The survey also indicated that 30% of respondents trusted the negative feedback on police reports on social networks.

The survey did not find a relationship between victims’ choice of reporting to the police or to law firms. However, the law offices claim to be able to recover the loss could possibly draw the victim’s attention when they became aware of scam and used Google search to find a savior.

These law firms in Japan are becoming a secondary source of victimization to the Japanese relationship scam victims because they paid retainer fees for investigation and recovery but end up with no positive results of the recovery which these victims were expecting.

The Advertisements By Law Offices in Japan “Specializing In Online Relationship Scams” Violates Basic Rules

The Tokyo, Japan Bar Association, and Chiba Bar Association warn about such law offices with misleading advertisements.

According to the Tokyo Bar Association in Japan, online lawyer advertisements that claim to be a specialist for online romance scams violate the Japanese Attorney Act, the Basic Rules of Lawyer Duties (referred to as the “Basic Rules”), or regulations regarding lawyer advertisements (referred to as the “Advertising Regulations”).

For example, the law firms claim that they had successfully recovered the full amount of the loss, which is likely to be a fictional case and does not align with reality. (Violations of factual accuracy or Article 3, Clause 1 of the Advertising Regulations). These advertisements claim 24/7 consultation services throughout the year, while only one lawyer is in place in the law firm. (Violations of factual accuracy or Article 3, Clause 1 of the Advertising Regulations). Some advertisements claim that consultations use LINE (messaging app popular in Japan), and, in reality, office clerks handle the messages from clients while lawyers do not provide any assistance. (Supervision of staff members or Article 19 of the Basic Rules, non-lawyer collaboration or Article 27 of the Attorney Act).2

Money Recovery In Japan – Not Necessary To Use Law Firms

The total recovery of the loss caused by online relationship fraud is mostly impossible. However, there are possible ways to recover part of the loss, from the domestic bank accounts used by scammers. [SCARS NOTE: increasingly, it is now possible to recovery cryptocurrency as well]

In recent years, since 2018, more Japanese bank accounts have been used for online relationship scams.

Between 2018 to 2021, 40% of Japanese victims came to the NPO CHARMS organization (under its former name “STOP romance scams”) for free consultation on Facebook, mentioning that their scammers were using Japanese bank accounts. The use of Japanese bank accounts enabled the scam victims to claim their loss by applying to the Criminal Accounts Damage Recovery Act.

The Criminal Accounts Damage Recovery Act is aimed to pay damage recovery benefits to the victims of financial crimes. (Act No. 133 of 2007) This enables the freezing of the bank account used by the criminals and distributes the amount left in the bank account to the victims who sent money to that account. Recently more Japanese bank accounts are used for online relationship scams, especially with the Pig butchering scams. If scam victims apply this procedure through the police agency and the bank, this is totally free of charge.

It is not wrong to use law offices to carry out this procedure on behalf of the scam victims. Some scam victims may be mentally and physically unable to carry out the procedures for recovery. But the victims should also be aware that the amount of money distributed from the bank account may be less than the retainer fee because only a small amount is left in the money mule’s bank account.

Negotiation With The Bank Account Owner Works?

Another possible recovery technique that scam victims may expect from law offices is direct negotiation with the bank account owners.

However, before accepting the offer of a lawyer who promises money recovery by negotiating with the bank account owner, victims should understand who the bank account owner is.

The bank accounts used by local fraudsters for recruiting and illegal job offers.

If the bank account user’s name indicates a foreigner’s name, such as former foreign students or workers who went back to their country. According to Nikkei Online (2019), the accounts can be sold for $250 to $400 USD, and foreign students and workers sell their Japanese bank accounts not knowing this is illegal to sell.3 In such cases, the bank account owners are no longer in Japan.

Money Mules

Another possible case is that the bank account owner is a scam victim, who was not aware of being used as a money mule. In the case of 419 fraud, scammers often make victims a money mule.

The scammers promise their victims that they will return the money, and a certain amount may be deposited into the victim’s bank account. Then the scammer may ask to transfer part of the “returned amount” to another place, such as a child’s guardian in the homeland. This kind of money mule is not aware of being used by criminals, and already lost huge amounts of money to the scammers and may not have sufficient funds to recover the loss.

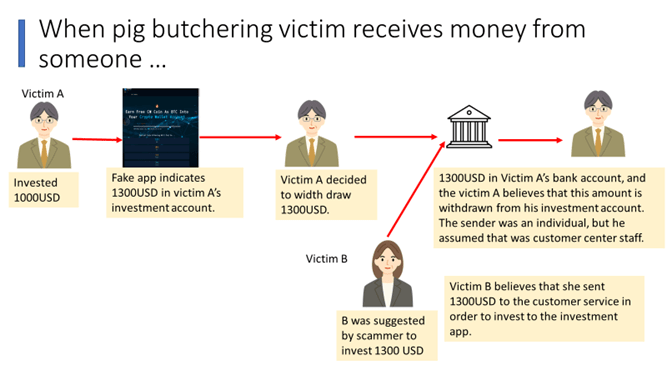

The Pig Butchering Investment scams have different tactics.

Figure 1 (below) shows how it works.

The Pig Butchering scam often allows the victims to withdraw a small amount of investment at the early stage of investment. For example, in this diagram, Victim A invested $1000USD which was increased to $1300USD. His scammer suggested he withdraw $1300USD, which is a trap to make him believe that the investment service is real. Then in another victim story, victim B was suggested by her scammer to invest $1300 USD. She was told to send the investment money to a personal bank account under Victim B’s name. Victim B believes that the $1300USD he has withdrawn from his own investment account, and the personal name of the sender was an investment service’s staff. On the other hand, victim B believes that the bank account in Victim B’s name belongs to the investment customer service. In this case, if you are Victim B and your lawyer says he can negotiate with Victim A to return money to you, then you also should think about whether you will someone with a personal name send any money to your bank account. This is because you also be receiving money from another scam victim.

What Victims In Japan Should Do For Recovery?

First, the relationship scam victims should report to the police

- It is free of charge to get help from police and bank to apply the procedure for the Criminal Accounts Damage Recovery Act.

- Reporting to the police have other benefit. This will help obtain other support programs, such as scholarships and local support systems for the needy.

- Reporting to the police also enhances the awareness of police officers in Japan regarding online relationship scams.

Then think about what a victim can expect from the law firm, with a realistic point of view

A full recovery of the loss is almost impossible. Then does it make sense to pay a retainer fee and receive a very small amount of distribution from the money mule’s frozen bank account? Is it realistic to accuse the owner of the bank account?

Using a law office works well when a victim needs a personal bankruptcy application.

Also, victims will need a lawyer’s assistance if a victim came to be involved as a money mule and is accused by another victim.

Footnotes

- Yahoo News. Japanese man arrested behind $2.9 million global “romance scam” arrested in Ghana. https://news.yahoo.com/japanese-man-behind-2-9m-114602299.html

- Tokyo Bar Association. Alert on law offices advertisements claim as specialized to the online romance scam issues. https://www.toben.or.jp/know/iinkai/hibenteikei/news/post_7.html

- Nikkei Online (2019.05.08) Banks rush to respond to account trading and money laundering hotbeds. https://www.nikkei.com/article/DGXMZO44479090X00C19A5EE9000/

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

More ScamsNOW.com Articles

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment above!

SCARS LINKS: AgainstScams.org RomanceScamsNOW.com ContraEstafas.org ScammerPhotos.com Anyscam.com ScamsNOW.com

reporting.AgainstScams.org support.AgainstScams.org membership.AgainstScams.org donate.AgainstScams.org shop.AgainstScams.org

youtube.AgainstScams.org linkedin.AgainstScams.org facebook.AgainstScams.org

ARTICLE RATING

TABLE OF CONTENTS

- In Japan, Law Firms “Specialized In The Romance Scams / Money Recovery” Come To The Top Of Search

- Why Victims Go To Japanese Law Offices Instead Of Police

- The Advertisements By Law Offices in Japan “Specializing In Online Relationship Scams” Violates Basic Rules

- Money Recovery In Japan – Not Necessary To Use Law Firms

- Negotiation With The Bank Account Owner Works?

- What Victims In Japan Should Do For Recovery?

- Footnotes

- Important Information for New Scam Victims

- Statement About Victim Blaming

- SCARS INSTITUTE RESOURCES:

- Psychology Disclaimer:

- More ScamsNOW.com Articles

- A Question of Trust

- SCARS Institute™ ScamsNOW Magazine

Society of Citizens Against Relationship Scams Inc. [SCARS]

CATEGORIES

MOST POPULAR COMMENTED ARTICLES

POPULAR ARTICLES

U.S. & Canada Suicide Lifeline 988

![NavyLogo@4x-81[1]](https://scamsnow.com/wp-content/uploads/2025/04/NavyLogo@4x-811.png)

ARTICLE META

WHAT PEOPLE ARE TALKING ABOUT LATEST SITE COMMENTS

See Comments for this Article at the Bottom of the Page

on Substance Abuse Susceptibility And Scam Victims – 2024: “It is understandable how some would feel that alcohol or substance abuse would be helpful in handling their feelings after…” Jul 1, 20:36

on Scam Victims Use Work To Avoid Healing: “The last 6 years have been the most difficult of my life. The pandemic, having both parents in the hospital…” Jun 29, 18:38

on Entitlement Mentality And How Scam Victims Often Lose Their Path To Recovery – 2024: “Thank you for this discussion of entitlement. I can see from the descriptions listed that I have not felt entitlement.…” Jun 29, 18:22

on Samurai Wisdom and Rituals for Clearing the Mind After Scam Trauma – 2025 – [VIDEOS]: “A great guide on how to move forward in our recovery process with a calm mind, cleansed on an ongoing…” Jun 28, 07:34

on Delayed Gratification and Patience in Scam Victim Recovery – 2025 – [VIDEOS]: “We want to recover quickly and… we make new mistakes. How not to speed up the recovery process, how to…” Jun 28, 06:41

on The Unique Injury Of Betrayal Trauma On Scam Victims – 2024: “Primarily because you did not see it coming” Jun 27, 23:57

on Changes In A Scam Victim’s Life: “I really detest the way my trust in others has been affected by the scamming I went through. I used…” Jun 27, 14:47

on The Unique Injury Of Betrayal Trauma On Scam Victims – 2024: “Betrayal Trauma is the worst feeling ever. Why does it seem so much worse when a scammer does that to…” Jun 27, 14:34

on EMDR Therapy For Scam Victims’ Trauma – A Part Of The Recovery Process For Many – 2024: “Very comprehensive article explaining all aspects of EMDR. I’d only heard of it before and now I have a much…” Jun 26, 19:01

on Forgiving Yourself After Surviving a Romance or Investment Scam – 2025: “Thank you for this valuable article. Self-forgiveness was for me the biggest step that led to my recovery. That also…” Jun 26, 17:28

on Counseling And Your Native Language: “These points make perfect sense. I can’t imagine trying to express complex emotions in a second language. I realize many…” Jun 26, 16:05

on Thought-Terminating Cliches – How What You and Others Say Stops Critical Thinking and Recovery for Scam Victims – 2025: “I didn’t realize that these “innocent phrases” clichés ending thoughts, can have such effect / negative -inhibiting / on our…” Jun 26, 14:48

on Scam Victim Resistance In Support Groups Therapy Or Counseling Can Destroy Opportunities For Recovery – 2024: “Working with either a support group or therapist to me means a self commitment to actively participating in the therapy.…” Jun 24, 21:01

on ‘I Just Want To Forget It’ – Denial & Avoidance Are Natural But Will Not Help Scam Victims On Their Path To Recovery From Scams – 2024: “My financial loss, the shock and betrayal of the crime ending all combined to fray my nerves and spend hours…” Jun 24, 20:10

on You Hate Being Told What To Do? How Your Rebellious Mentality Can Sabotage Your Recovery – 2025: “I am a bit of a rebel, and the moment someone tells me to do something, worse, does it even…” Jun 24, 15:04

on You Hate Being Told What To Do? How Your Rebellious Mentality Can Sabotage Your Recovery – 2025: “You are very welcome” Jun 24, 03:01

on You Hate Being Told What To Do? How Your Rebellious Mentality Can Sabotage Your Recovery – 2025: “This is a great article, which makes perfect sense as to why anyone would resist the help offered to them.…” Jun 23, 20:01

on Scam Victims’ Responsibilities – 2021 [Updated 2025]: “Thank you for this article. As I continue my journey, I focus on the here and now and let the…” Jun 21, 16:26

on Scam Victims Avoid Or Escape The Aftermath Of Scams – How Denial And Distraction Avoid Confronting Reality – 2024: “In the earliest days after my crime I felt powerless, helpless and weak. I had been through so much in…” Jun 21, 14:46

Important Information for New Scam Victims

Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

SCARS Institute now offers a free recovery program at www.SCARSeducation.org

Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors, please visit counseling.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

Statement About Victim Blaming

Some of our articles discuss various aspects of victims. This is both about better understanding victims (the science of victimology) and their behaviors and psychology. This helps us to educate victims/survivors about why these crimes happened and not to blame themselves, better develop recovery programs, and help victims avoid scams in the future. At times, this may sound like blaming the victim, but it does not blame scam victims; we are simply explaining the hows and whys of the experience victims have.

These articles, about the Psychology of Scams or Victim Psychology – meaning that all humans have psychological or cognitive characteristics in common that can either be exploited or work against us – help us all to understand the unique challenges victims face before, during, and after scams, fraud, or cybercrimes. These sometimes talk about some of the vulnerabilities the scammers exploit. Victims rarely have control of them or are even aware of them, until something like a scam happens, and then they can learn how their mind works and how to overcome these mechanisms.

Articles like these help victims and others understand these processes and how to help prevent them from being exploited again or to help them recover more easily by understanding their post-scam behaviors. Learn more about the Psychology of Scams at www.ScamPsychology.org

SCARS INSTITUTE RESOURCES:

If You Have Been Victimized By A Scam Or Cybercrime

♦ If you are a victim of scams, go to www.ScamVictimsSupport.org for real knowledge and help

♦ Enroll in SCARS Scam Survivor’s School now at www.SCARSeducation.org

♦ To report criminals, visit https://reporting.AgainstScams.org – we will NEVER give your data to money recovery companies like some do!

♦ Follow us and find our podcasts, webinars, and helpful videos on YouTube: https://www.youtube.com/@RomancescamsNowcom

♦ Learn about the Psychology of Scams at www.ScamPsychology.org

♦ Dig deeper into the reality of scams, fraud, and cybercrime at www.ScamsNOW.com and www.RomanceScamsNOW.com

♦ Scam Survivor’s Stories: www.ScamSurvivorStories.org

♦ For Scam Victim Advocates visit www.ScamVictimsAdvocates.org

♦ See more scammer photos on www.ScammerPhotos.com

You can also find the SCARS Institute on Facebook, Instagram, X, LinkedIn, and TruthSocial

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this and other SCARS articles are intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

Note about Mindfulness: Mindfulness practices have the potential to create psychological distress for some individuals. Please consult a mental health professional or experienced meditation instructor for guidance should you encounter difficulties.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here

If you are in crisis, feeling desperate, or in despair, please call 988 or your local crisis hotline.

More ScamsNOW.com Articles

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish. Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors’ experience. You can do Google searches, but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

![scars-institute[1]](https://scamsnow.com/wp-content/uploads/2025/04/scars-institute1.png)

![niprc1.png1_-150×1501-1[1]](https://scamsnow.com/wp-content/uploads/2025/04/niprc1.png1_-150x1501-11.webp)