UNODC Report: Casinos and Cryptocurrency

Understanding the Complexities of Large Scale Organized Crime in Southeast Asia

Primary Category: Organized Crime

Authors:

• SCARS Editorial Team – Society of Citizens Against Relationship Scams Inc.

• UNODC Regional Office for Southeast Asia and the Pacific

About This Article

A new report has revealed that casinos, junkets, and cryptocurrency exchanges are major drivers of money laundering, underground banking, and cyberfraud in East and Southeast Asia. The study, titled “Casinos, Money Laundering, Underground Banking, and Transnational Organized Crime in East and Southeast Asia: A Hidden, Accelerating Threat,” highlights the crucial role of underregulated online casinos and crypto exchanges in facilitating transnational organized crime.

These platforms allow for faster, anonymized transactions and the commingling of funds, which have significantly expanded the region’s illicit economy. The report details how organized crime groups use these methods to launder massive volumes of both fiat and cryptocurrencies, integrating billions of criminal proceeds into the financial system.

Cases have shown that illegal online casino operators diversify into cyberfraud and cryptocurrency laundering, often operating in areas controlled by armed groups to conceal their activities. Despite some enforcement actions causing partial displacement, organized crime continues to exploit vulnerabilities in the region. The report underscores the urgent need for enhanced legislative and regulatory measures to address this escalating threat.

UNODC Report – Casinos and Cryptocurrency: Major Drivers of Money Laundering, Underground Banking, and Cyberfraud in East and Southeast Asia

A new report issued today has found that casinos, junkets, and cryptocurrency have emerged as a critical piece of the underground banking and money laundering infrastructure in East and Southeast Asia, fuelling transnational organized crime in the region.

Titled ‘Casinos, Money Laundering, Underground Banking, and Transnational Organized Crime in East and Southeast Asia: A Hidden, Accelerating Threat’, the study highlights the nexus between illegal online casinos, e-junkets, and cryptocurrency exchanges that have proliferated in recent years alongside surging cross-border criminality throughout the region.

“Casinos and related high-cash-volume businesses have been vehicles for underground banking and money laundering for years, but the explosion of underregulated online gambling platforms and crypto exchanges has changed the game,” said Jeremy Douglas, UNODC Regional Representative for Southeast Asia and the Pacific. “Expansion of the illicit economy has required a technology-driven revolution in underground banking to allow for faster-anonymized transactions, commingling of funds, and new business opportunities for organized crime. The development of scalable, digitized casino- and crypto-based solutions has supercharged the criminal business environment across Southeast Asia, and particularly in the Mekong.”

As outlined in the report, countless recent cases demonstrate that online casinos and related businesses have been used by major organized crime groups to move and launder massive volumes of state-backed fiat as well as cryptocurrencies, effectively creating channels for integrating billions in criminal proceeds into the financial system. At the same time, the creation and success of these underground banking mechanisms has helped expand the region’s broader illicit economy, in turn attracting new networks, innovators, and service providers to the criminal ecosystem.

Cases examined also highlight how illegal online casino operators have diversified business lines to include cyberfraud and cryptocurrency laundering, with extensive evidence of organized crime influence within casino compounds, special economic zones and border areas, including those controlled by armed groups in Myanmar to conceal illicit activities.

“Organized crime groups have converged where they see vulnerabilities, and casinos and crypto have proven the point of least resistance,” Douglas added. “That said, operations against syndicates in countries including Cambodia and the Philippines have caused a partial displacement, and we have seen criminals moving infrastructure into other places where they see opportunity — basically where they expect they will be able to take advantage and not be held to account, to remote and border areas of the Mekong, and recently elsewhere.”

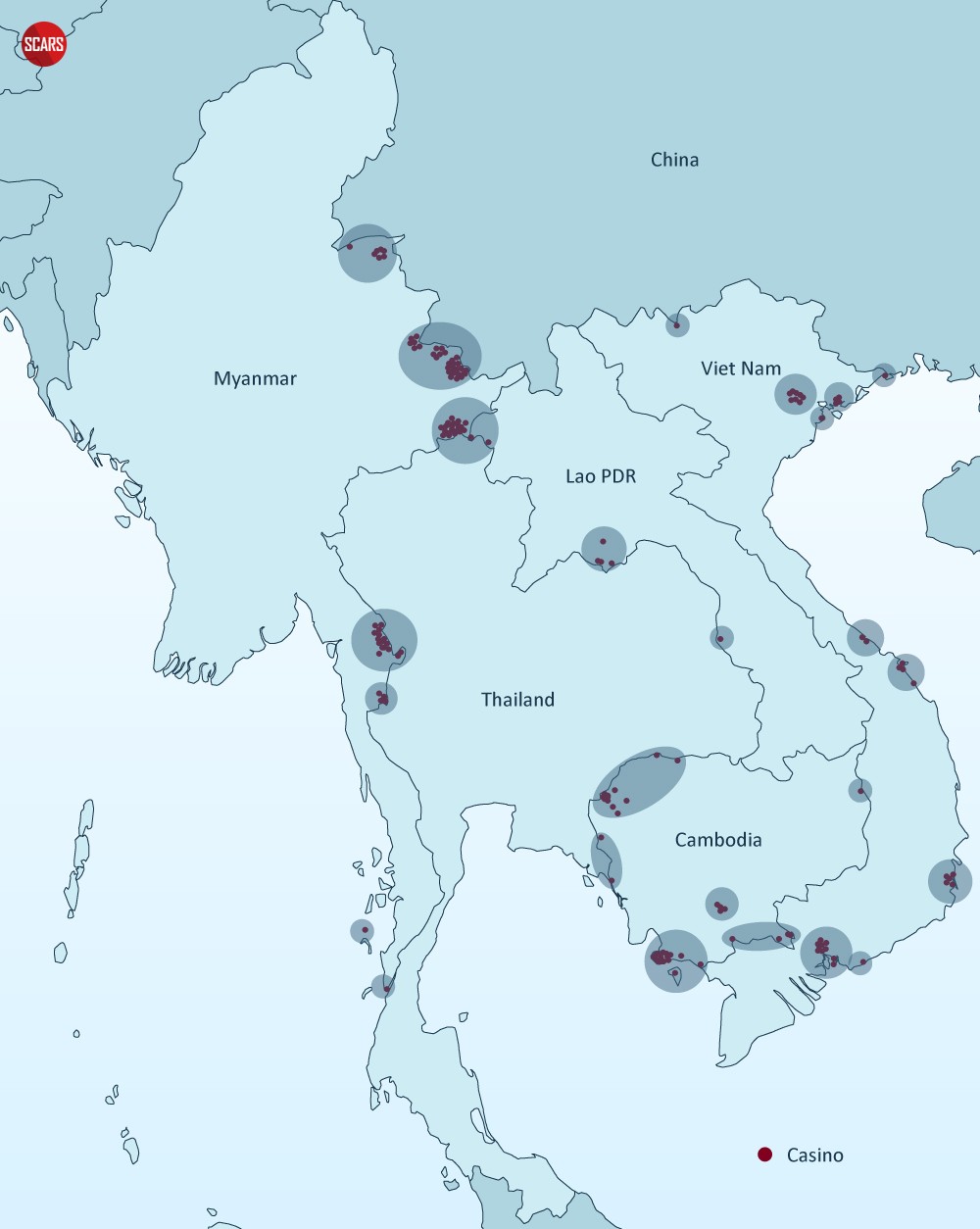

UNODC analysis estimates there were more than 340 licensed and unlicensed land-based casinos operating in Southeast Asia as of early 2022, with most having shifted online to offer live-dealer streaming and various proxy betting services. According to latest available industry data, the formal online gambling market is projected to grow to more than US $205 billion by 2030, with the Asia Pacific region representing the largest share of market growth between 2022 to 2026 at a projected 37%. The study describes several policy developments and enforcement measures implemented by governments in the region to address illegal casino-based capital outflows, corruption, and money laundering that have in part driven these trends.

The technical policy brief describes the mechanics, intricacies, and drivers of underground banking in the region, and has been developed through extensive examination and analysis of criminal indictments, case records, court filings, related public disclosure, and other data collected in consultation with authorities and partners over more than a year. Its development has included an extensive mapping and analysis of thousands of so-called ‘grey and black business’ online groups, including clear web and dark web forums and marketplaces, used for illicit activities. The study also provides a list of recommendations geared towards strengthening knowledge and awareness, legislation and policy, and enforcement and regulatory responses in the region, intended to assist governments to address the situation.

“It’s clear that the gap between organized crime and enforcement authorities is widening quickly. If the region fails to address this criminal landscape the consequences will be seen in Southeast Asia and beyond as criminals look to reinvest profits and innovate operations,” stated Benedikt Hofmann, UNODC Deputy Regional Representative. “We trust the report will prove as a useful reference for deeper engagement between countries in Southeast Asia, UNODC, and international partners,” Hofmann said. “At this point, we are just scratching the surface.”

Read the new report here.

Locations of casinos in lower Mekong countries in 2022.

Source: UNODC elaboration based on information obtained through various channels, including its Country Offices in Southeast Asia and field researchers.

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims.

- SCARS Institute now offers its free, safe, and private Scam Survivor’s Support Community at www.SCARScommunity.org – this is not on a social media platform, it is our own safe & secure platform created by the SCARS Institute especially for scam victims & survivors.

- SCARS Institute now offers a free recovery learning program at www.SCARSeducation.org.

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery.

If you are looking for local trauma counselors, please visit counseling.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

Statement About Victim Blaming

Some of our articles discuss various aspects of victims. This is both about better understanding victims (the science of victimology) and their behaviors and psychology. This helps us to educate victims/survivors about why these crimes happened and not to blame themselves, better develop recovery programs, and help victims avoid scams in the future. At times, this may sound like blaming the victim, but it does not blame scam victims; we are simply explaining the hows and whys of the experience victims have.

These articles, about the Psychology of Scams or Victim Psychology – meaning that all humans have psychological or cognitive characteristics in common that can either be exploited or work against us – help us all to understand the unique challenges victims face before, during, and after scams, fraud, or cybercrimes. These sometimes talk about some of the vulnerabilities the scammers exploit. Victims rarely have control of them or are even aware of them, until something like a scam happens, and then they can learn how their mind works and how to overcome these mechanisms.

Articles like these help victims and others understand these processes and how to help prevent them from being exploited again or to help them recover more easily by understanding their post-scam behaviors. Learn more about the Psychology of Scams at www.ScamPsychology.org

SCARS INSTITUTE RESOURCES:

If You Have Been Victimized By A Scam Or Cybercrime

♦ If you are a victim of scams, go to www.ScamVictimsSupport.org for real knowledge and help

♦ SCARS Institute now offers its free, safe, and private Scam Survivor’s Support Community at www.SCARScommunity.org/register – this is not on a social media platform, it is our own safe & secure platform created by the SCARS Institute especially for scam victims & survivors.

♦ Enroll in SCARS Scam Survivor’s School now at www.SCARSeducation.org

♦ To report criminals, visit https://reporting.AgainstScams.org – we will NEVER give your data to money recovery companies like some do!

♦ Follow us and find our podcasts, webinars, and helpful videos on YouTube: https://www.youtube.com/@RomancescamsNowcom

♦ Learn about the Psychology of Scams at www.ScamPsychology.org

♦ Dig deeper into the reality of scams, fraud, and cybercrime at www.ScamsNOW.com and www.RomanceScamsNOW.com

♦ Scam Survivor’s Stories: www.ScamSurvivorStories.org

♦ For Scam Victim Advocates visit www.ScamVictimsAdvocates.org

♦ See more scammer photos on www.ScammerPhotos.com

You can also find the SCARS Institute’s knowledge and information on Facebook, Instagram, X, LinkedIn, and TruthSocial

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this and other SCARS articles are intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

Note about Mindfulness: Mindfulness practices have the potential to create psychological distress for some individuals. Please consult a mental health professional or experienced meditation instructor for guidance should you encounter difficulties.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here

If you are in crisis, feeling desperate, or in despair, please call 988 or your local crisis hotline – international numbers here.

More ScamsNOW.com Articles

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish. Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors’ experience. You can do Google searches, but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

![NavyLogo@4x-81[1] UNODC Report: Casinos and Cryptocurrency - 2024](https://scamsnow.com/wp-content/uploads/2025/04/NavyLogo@4x-811.png)

![scars-institute[1] UNODC Report: Casinos and Cryptocurrency - 2024](https://scamsnow.com/wp-content/uploads/2025/04/scars-institute1.png)

![niprc1.png1_-150×1501-1[1] UNODC Report: Casinos and Cryptocurrency - 2024](https://scamsnow.com/wp-content/uploads/2025/04/niprc1.png1_-150x1501-11.webp)