3 Smart Bank Strategies to Stop Scams

By Ken Palla, Retired Director, MUFG Union Bank – Courtesy of BioCatch

3 Smart Strategies to Stop Scams That Don’t Break the Bank

In the first part of this blog series on financial scams, Dr. Tim McGuinness and Debby Montgomery Johnson (also a scam victim herself), Board Directors at the Society of Citizens Against Relationship Scams (SCARS) talked about how to interact with potential scam victims once there was a potential scam transaction alert. In this article, we will look at some specific initiatives that FIs use once they get a scam alert and ways to improve customer education.

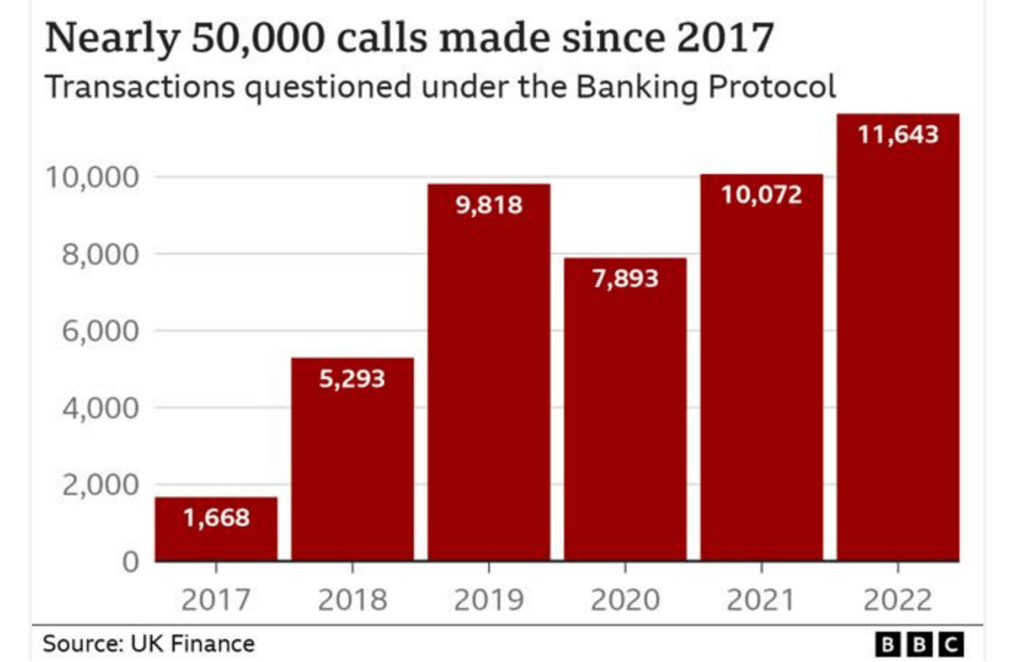

The UK is the first country to embark on a serious effort to add controls to help reduce customer scam losses. One of the controls is called the Banking Protocol. When a customer comes into a bank branch and requests a suspicious transaction (e.g., withdraw £20,000 in cash), the branch staff are authorized to call the local police to the branch to help intervene with the customer. The BBC reported that the Banking Protocol was used 11,643 times in 2022 and nearly 50,000 times since 2017. See the figure below.

According to the BBC article, the use of the Banking Protocol saved £55 million in 2022 and £258 million since its inception in 2017. For this to work, UK bank staff had to be trained “to detect the warning signs that someone is being scammed.”

How Banks are Introducing Friction to Protect Customers

I talked with a UK banker to see what they are doing with scam alerts. The banker stated, “The only real way to get customers to come out from under the spell of scammers is to add friction to the customer journey, and as you well know in the banking sector, business and channel design teams are often reluctant to do this.”

So how does the bank introduce friction? In the online channel, there are multiple points along the journey where customers are ‘challenged’ on the purpose of the payment, whether they know who they are paying, and whether they have recently been contacted by someone pretending to be the bank or another organization requesting them to move money. This messaging is tied to the type of transaction. If the payment is for an investment, then investment scam questions will be presented. During the online session, the payment can be delayed, and the customer is asked to call in.

The banker I spoke to noted they are seeing UK fintechs adding more intricate friction. One example is having the customer provide a photo selfie with a visible handwritten sign containing a code from the mobile app. It is a clever way to get the customer to step back from the payment journey, and get a phone, a pen, and a piece of paper. As the banker notes, “In doing so, it may get them out from under the spell and back to their rational brain.”

Another example comes from Australia. National Australia Bank (NAB) recently reported that $270 million worth of transactions and a daily average of 12% of payments in the NAB app were abandoned after a customer received a payment prompt, based on a 15-week period between March 2023 and July 2023. NAB controls had identified these transactions as “scam suspicious” and initiated payment prompts to their customers. As one NAB executive explained, “While we’re focused on making banking simple and digital, we’ve added this extra friction to help alert customers to warning signs.” As an aside, due to the high volume of cryptocurrency scams in Australia, NAB is now outright blocking some payments made to high-risk cryptocurrency exchanges.

Making Customer Education More Effective

In talking with Dr McGuinness, Director at SCARS, he provided insights on how the industry can improve customer education. Dr. McGuinness noted that the information on scams he typically sees being shared with customers is too generic. Plus, scam victims never thought it would ever happen to them.

Dr. McGuinness recommends creating educational material that addresses the actual mechanics of the scams. Here are some of the ways he talks about identifying a scam:

- Did a stranger contact you out of the blue? On social media, online games, through a text or message, or an email?

- Did they express feelings for you in less than a month? Or offer unsolicited financial or investment advice?

- Did they regularly ask for personal information about your likes, what you do, and your daily routine? Do they dig deep into having you talk about yourself?

- Is there some sense of urgency or time-based need or opportunity that needs money such as something wrong with a family member, a financial or government account, or an issue that has to be addressed immediately?

- Do they offer you huge gains on an investment, or have a box of gold or money from an inheritance, or huge profits from a business?

- Do they want you to keep secrets?

Summary

As scam levels rise globally, it is clear what we are doing today is not working, and new strategies need to be deployed. Some of the strategies discussed in this article are low-hanging fruit that can be tried without having to consume tremendous resources. First, some level of smart friction needs to be introduced, especially in real-time payment systems. This might not be a popular choice for some internal stakeholders, but if done right, it can have positive outcomes.

Second, bank fraud staff need to be trained to deal with customers who have been mentally manipulated by the scammer. A great example of this is Santander’s Break the Spell team who are specially trained to work with customers suspected of being victims of romance scams.

Finally, customer education and communication need to change. More focus should be put on the actual mechanics used by the scammer to manipulate a victim as well as providing more effective alerts to customers during the transaction process.

SCARS Resources:

- For New Victims of Relationship Scams newvictim.AgainstScams.org

- Subscribe to SCARS Newsletter newsletter.againstscams.org

- Sign up for SCARS professional support & recovery groups, visit support.AgainstScams.org

- Find competent trauma counselors or therapists, visit counseling.AgainstScams.org

- Become a SCARS Member and get free counseling benefits, visit membership.AgainstScams.org

- Report each and every crime, learn how to at reporting.AgainstScams.org

- Learn more about Scams & Scammers at RomanceScamsNOW.com and ScamsNOW.com

- Global Cyber Alliance ACT Cybersecurity Tool Website: Actionable Cybersecurity Tools (ACT) (globalcyberalliance.org)

- Self-Help Books for Scam Victims are at shop.AgainstScams.org

- Donate to SCARS and help us help others at donate.AgainstScams.org

- Worldwide Crisis Hotlines: International Suicide Hotlines – OpenCounseling : OpenCounseling

- Campaign To End Scam Victim Blaming – 2024 (scamsnow.com)

More:

- Bank Customer Interventions (scamsnow.com)

- A SCARS Proposal To Stop Money Transfer (APP) Fraud (scamsnow.com)

- Banks May Have To Give You Your Money Back – U.S. Banking Change (romancescamsnow.com)

- Bank staff defy customers to prevent £55m of fraud in 2022 – BBC News (ampproject.org)

- UK Identifies Meta As Responsible For 61% Of APP Fraud (scamsnow.com)

- NAB’s scam alerts intervene in $270 million worth of payments – NAB News

- We join bank staff protecting victims’ life savings from romance scams | This is Money

- Use Your Brain When You Create Scam Warnings for Customers (biocatch.com)

- Bank Account Takeover Fraud Can Happen To You! A Victim’s Story! (scamsnow.com)

- Source: 3 Smart Strategies to Stop Scams That Don’t Break the Bank (biocatch.com)

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

More ScamsNOW.com Articles

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment above!

SCARS LINKS: AgainstScams.org RomanceScamsNOW.com ContraEstafas.org ScammerPhotos.com Anyscam.com ScamsNOW.com

reporting.AgainstScams.org support.AgainstScams.org membership.AgainstScams.org donate.AgainstScams.org shop.AgainstScams.org

youtube.AgainstScams.org linkedin.AgainstScams.org facebook.AgainstScams.org

ARTICLE RATING

TABLE OF CONTENTS

CATEGORIES

MOST POPULAR COMMENTED ARTICLES

POPULAR ARTICLES

U.S. & Canada Suicide Lifeline 988

![NavyLogo@4x-81[1]](https://scamsnow.com/wp-content/uploads/2025/04/NavyLogo@4x-811.png)

ARTICLE META

WHAT PEOPLE ARE TALKING ABOUT LATEST SITE COMMENTS

See Comments for this Article at the Bottom of the Page

on Transference And Emotional Danger After The Scam – 2024: “Thank you for the kind but firm reminder that the person in the stolen profile photo has their own life.…” Jul 9, 01:26

on ‘Mental Defeat’ – The Unique Condition Of Giving Up – 2024: “Thank you for another great article. I can see from this article that mental defeat would be debilitating to a…” Jul 9, 00:49

on Trust: Romance Scams Betrayal And Scam Victims – 2024: “This provided valuable insight that I can identify with” Jul 8, 16:44

on A Scam Victim in Extreme Distress – Stopping the Pain – 2024: “Your trust issues are very understandable. We are very sorry this happened to you. We suggest that you contact an…” Jul 8, 14:42

on A Scam Victim in Extreme Distress – Stopping the Pain – 2024: “My online counselors advised me to check myself in. I went to the hospital because I was suicidal. After I…” Jul 8, 13:44

on Scam Victim Catastrophizing Making Recovery Difficult 2024: “Excellent article on catastrophizing. I can understand how this could take a person down a rabbit warren of never ending…” Jul 8, 12:12

on The Self-Pity Trap & How To Overcome It – 2023 – [UPDATED 2025]: “I am not in the habit of feeling sorry for myself. After the deception, although it was not easy at…” Jul 8, 11:49

on Pride – A Dual Edged Sword For Scam Victims – 2023 [UPDATD 2024]: “Looking back over my life I have seen how pride has impacted me both positively and negatively. However the negative…” Jul 8, 09:08

on The Self-Pity Trap & How To Overcome It – 2023 – [UPDATED 2025]: “I felt self-pity while the enormity of my financial loss washed over me like a tsunami. The self-pity lasted only…” Jul 7, 18:55

on The Uniqueness Of Scam Victims Or Fraud Victims – 2024: “unfortunately all true. It is highly stressful dealing with the aftermath. I am being sued for the money I borrowed…” Jul 6, 12:50

on Scam Victims & Mental Health Blaming – 2023 [UPDATED 2025]: “For most of my life words have defeated me, made me feel insignificant, unwanted, unneeded. For this reason it is…” Jul 5, 13:36

on Substance Abuse Susceptibility And Scam Victims – 2024: “It is understandable how some would feel that alcohol or substance abuse would be helpful in handling their feelings after…” Jul 1, 20:36

on Scam Victims Use Work To Avoid Healing: “The last 6 years have been the most difficult of my life. The pandemic, having both parents in the hospital…” Jun 29, 18:38

on Entitlement Mentality And How Scam Victims Often Lose Their Path To Recovery – 2024: “Thank you for this discussion of entitlement. I can see from the descriptions listed that I have not felt entitlement.…” Jun 29, 18:22

on Samurai Wisdom and Rituals for Clearing the Mind After Scam Trauma – 2025 – [VIDEOS]: “A great guide on how to move forward in our recovery process with a calm mind, cleansed on an ongoing…” Jun 28, 07:34

on Delayed Gratification and Patience in Scam Victim Recovery – 2025 – [VIDEOS]: “We want to recover quickly and… we make new mistakes. How not to speed up the recovery process, how to…” Jun 28, 06:41

on The Unique Injury Of Betrayal Trauma On Scam Victims – 2024: “Primarily because you did not see it coming” Jun 27, 23:57

on Changes In A Scam Victim’s Life: “I really detest the way my trust in others has been affected by the scamming I went through. I used…” Jun 27, 14:47

on The Unique Injury Of Betrayal Trauma On Scam Victims – 2024: “Betrayal Trauma is the worst feeling ever. Why does it seem so much worse when a scammer does that to…” Jun 27, 14:34

Important Information for New Scam Victims

Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

SCARS Institute now offers a free recovery program at www.SCARSeducation.org

Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors, please visit counseling.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

Statement About Victim Blaming

Some of our articles discuss various aspects of victims. This is both about better understanding victims (the science of victimology) and their behaviors and psychology. This helps us to educate victims/survivors about why these crimes happened and not to blame themselves, better develop recovery programs, and help victims avoid scams in the future. At times, this may sound like blaming the victim, but it does not blame scam victims; we are simply explaining the hows and whys of the experience victims have.

These articles, about the Psychology of Scams or Victim Psychology – meaning that all humans have psychological or cognitive characteristics in common that can either be exploited or work against us – help us all to understand the unique challenges victims face before, during, and after scams, fraud, or cybercrimes. These sometimes talk about some of the vulnerabilities the scammers exploit. Victims rarely have control of them or are even aware of them, until something like a scam happens, and then they can learn how their mind works and how to overcome these mechanisms.

Articles like these help victims and others understand these processes and how to help prevent them from being exploited again or to help them recover more easily by understanding their post-scam behaviors. Learn more about the Psychology of Scams at www.ScamPsychology.org

SCARS INSTITUTE RESOURCES:

If You Have Been Victimized By A Scam Or Cybercrime

♦ If you are a victim of scams, go to www.ScamVictimsSupport.org for real knowledge and help

♦ Enroll in SCARS Scam Survivor’s School now at www.SCARSeducation.org

♦ To report criminals, visit https://reporting.AgainstScams.org – we will NEVER give your data to money recovery companies like some do!

♦ Follow us and find our podcasts, webinars, and helpful videos on YouTube: https://www.youtube.com/@RomancescamsNowcom

♦ Learn about the Psychology of Scams at www.ScamPsychology.org

♦ Dig deeper into the reality of scams, fraud, and cybercrime at www.ScamsNOW.com and www.RomanceScamsNOW.com

♦ Scam Survivor’s Stories: www.ScamSurvivorStories.org

♦ For Scam Victim Advocates visit www.ScamVictimsAdvocates.org

♦ See more scammer photos on www.ScammerPhotos.com

You can also find the SCARS Institute on Facebook, Instagram, X, LinkedIn, and TruthSocial

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this and other SCARS articles are intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

Note about Mindfulness: Mindfulness practices have the potential to create psychological distress for some individuals. Please consult a mental health professional or experienced meditation instructor for guidance should you encounter difficulties.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here

If you are in crisis, feeling desperate, or in despair, please call 988 or your local crisis hotline.

More ScamsNOW.com Articles

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish. Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors’ experience. You can do Google searches, but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

![scars-institute[1]](https://scamsnow.com/wp-content/uploads/2025/04/scars-institute1.png)

![niprc1.png1_-150×1501-1[1]](https://scamsnow.com/wp-content/uploads/2025/04/niprc1.png1_-150x1501-11.webp)