New Bankrate Survey Shows Scams Increasing

Scams Increasing and Exposure on the Rise: What the Bankrate Survey Reveals and How You Can Protect Yourself

Primary Category: Criminology

Intended Audience: General Public

Authors:

• SCARS Editorial Team – Society of Citizens Against Relationship Scams Inc.

• Source: https://www.bankrate.com/credit-cards/news/financial-fraud-survey/

About This Article

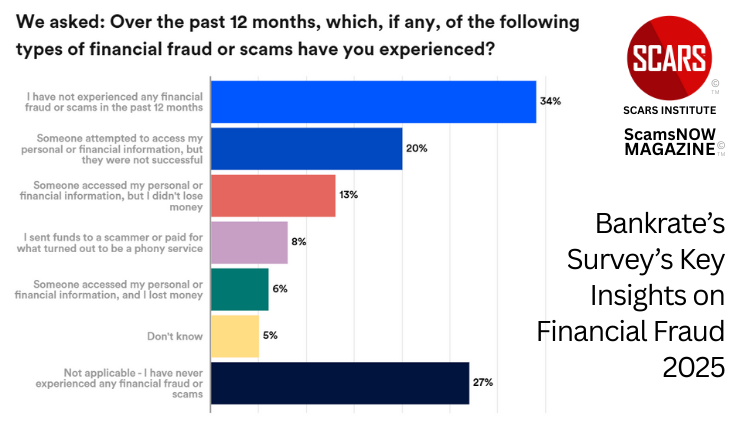

Financial fraud is becoming more widespread, with 34 percent of Americans experiencing a scam in the past year and 37 percent of those victims losing money, according to the Bankrate Financial Fraud Survey. Scammers are using increasingly sophisticated tactics, from fake job offers to investment fraud, exploiting emotions like fear and urgency to manipulate victims.

The survey highlights that past fraud experiences shape future expectations, with 61 percent of recent victims believing they will be targeted again. While nearly 89 percent of Americans have taken steps to protect themselves, scams continue to evolve, emphasizing the need for vigilance, financial awareness, and proactive security measures to minimize risk and prevent losses.

Scams Increasing and Exposure on the Rise: What the Bankrate Survey Reveals and How You Can Protect Yourself

The reality of financial fraud and scams is more prevalent than ever, as highlighted in the recent Bankrate Financial Fraud Survey. The survey found that more than one in three Americans (34 percent) have faced financial fraud or a scam in the past year. Even more concerning, 37 percent of those victims lost money. With scams evolving beyond traditional phishing emails and fraudulent phone calls to more sophisticated tactics like investment schemes and fake job offers, it is clear that consumers need to remain vigilant.

The Ever Increasing Threat of Financial Scams

The survey highlights the alarming scope of financial scams in the U.S. Nearly 68 percent of Americans have experienced fraud or a scam at some point in their lives. The frequency of scams is increasing, with criminals exploiting digital platforms and social engineering tactics to deceive individuals. Victims often report scammers accessing their financial information, with nearly 23 percent of those who lost money sending funds directly to fraudsters or paying for fake services.

Bankrate’s findings confirm that scammers prey on emotions—manipulating victims into parting with their money through fear, excitement, or urgency. The emotional toll of fraud is just as damaging as the financial losses, as more than 60 percent of victims believe they will be targeted again in the near future. This shows that being scammed does not just cause financial harm—it leads to ongoing fear, anxiety, and distress.

Understanding the Reality Behind the Bankrate Survey Findings

Financial scams have become a pervasive threat in modern society, affecting individuals across all demographics. With increasing reliance on digital transactions, social media interactions, and online commerce, fraudsters have more opportunities than ever to exploit vulnerabilities. The latest Bankrate Financial Fraud Survey highlights the scale of this crisis, revealing that more than one in three American adults (34%) have been targeted by financial fraud in the past year alone. Even more troubling, nearly two in five victims (37%) suffered monetary losses.

The findings paint a stark picture of the modern financial landscape, illustrating the deceptive tactics used by scammers and the lasting impact on victims. Beyond financial loss, the survey underscores the emotional toll scams take, with 61% of recent fraud victims believing they will be targeted again in the near future. This ongoing fear and vulnerability make it essential to examine why scams are so prevalent, who is most at risk, and how individuals can protect themselves from falling victim to fraudulent schemes.

Why Are Financial Scams Becoming More Prevalent?

The rise in financial scams can be attributed to multiple factors. Sarah Foster, Bankrate’s U.S. Economic Analyst, points out that modern scams extend beyond the obvious, typo-ridden messages that were once easy to spot. Fraudsters have refined their tactics, using more sophisticated methods, including:

- Fake job offers requiring payment to secure an interview or background check

- Investment fraud, particularly in high-risk or emerging markets like cryptocurrency

- Romance scams, in which scammers build relationships online to manipulate victims into sending money

- Impersonation scams, where fraudsters pose as banks, government officials, or tech support to steal sensitive data

- “Hostage” scams that claim a loved one is in danger unless a ransom is paid

Fraudsters often use social engineering techniques to manipulate victims into acting impulsively. By instilling urgency, fear, or excitement, scammers make people more likely to ignore red flags and comply with their demands.

Who is Most at Risk?

Scams do not discriminate, but certain demographics appear to be more vulnerable. Baby boomers (ages 61-79) and Generation X (ages 45-60) are most likely to have been scammed in their lifetime. However, younger generations, particularly Gen Z (ages 18-28), are at higher risk of actually losing money when targeted. Over half (53 percent) of Gen Z scam victims in the past year lost money, compared to just 26 percent of baby boomers.

Income also plays a role in vulnerability to scams. Americans earning under $50,000 per year were the most likely to experience fraud in the past year (37 percent), and they were also the most likely to lose money. Financial stress and the need for quick solutions may make lower-income individuals more susceptible to scams that promise financial relief, easy job opportunities, or instant returns on investments.

While financial scams affect individuals across all income levels and age groups, the Bankrate survey identifies trends regarding vulnerability:

- Older Generations Are More Likely to Experience Fraud: Baby boomers (61-79) and Generation X (45-60) are the most likely to have encountered financial scams, with 73% and 71%, respectively, reporting being targeted at some point in their lives. However, younger generations are not immune.

- Gen Z and Millennials Lose Money More Often: Despite experiencing fewer scams overall, younger victims are more likely to lose money when targeted. Among recent victims, 53% of Gen Zers and 45% of Millennials suffered financial losses, compared to 32% of Gen Xers and 26% of Baby Boomers.

- Lower-Income Americans Are More Vulnerable: Individuals earning under $50,000 annually are disproportionately affected by scams. 37% reported encountering financial fraud in the past year, and 40% of those victims lost money. Economic hardship often increases susceptibility to scams that promise financial relief or quick gains.

The Psychological Impact of Scams

One of the most striking findings from the Bankrate survey is that past fraud experiences shape victims’ expectations of being scammed again. Nearly half of all individuals who have been scammed before (46 percent) believe they will experience fraud in the next 12 months. For those who were scammed in the past year, that number jumps to 61 percent. This highlights the psychological damage that scams inflict—not only do victims face financial hardship, but they also live in fear of being targeted again.

This persistent fear can lead victims to avoid financial decisions, distrust legitimate institutions, and even fall into cycles of paranoia. Unfortunately, this fear sometimes drives people to seek information in unreliable sources, leading to the spread of misinformation and conspiracy theories about scams. Misinformation not only harms victims but also undermines legitimate efforts to combat fraud through education and law enforcement.

One of the most significant but often overlooked consequences of financial scams is their psychological impact. Fraud does not just result in financial loss—it erodes trust, confidence, and emotional well-being. Victims frequently experience:

- Shame and Self-Blame: Many victims feel foolish for falling for scams, preventing them from seeking help or reporting the fraud.

- Anxiety and Paranoia: Fear of being targeted again can make victims hesitant to engage in normal financial transactions, leading to isolation and avoidance behaviors.

- Mistrust Toward Institutions: Victims who believe law enforcement or financial institutions failed to protect them may withdraw from traditional financial systems, making them even more vulnerable to future fraud.

What Can You Do to Protect Yourself?

While scams are a growing threat, the Bankrate survey also found that nearly 89 percent of Americans have taken steps to protect themselves from fraud in the past year. Some of the most common protective measures include:

Taking multiple protective measures significantly reduces the likelihood of falling victim to a scam. The survey found that 77 percent of Americans have taken at least two of these steps, and 51 percent have implemented four or more. However, despite these efforts, scammers continue to find new ways to exploit individuals, which is why ongoing vigilance is necessary.

What Steps Are Americans Taking to Protect Themselves?

Despite the prevalence of scams, 89% of Americans have taken at least one action to safeguard themselves in the past year. The most common protective measures include:

-

-

- Avoiding Suspicious Links: 69% refrain from clicking on questionable emails or messages.

- Monitoring Financial Accounts: 53% check their bank and credit card statements regularly.

- Using Two-Factor Authentication: 49% have enabled multi-step verification for added security.

- Updating Passwords: 46% have strengthened their account passwords to reduce vulnerability.

- Checking Credit Reports: 41% review their credit histories for unauthorized activity.

- Shredding Sensitive Documents: 39% take extra precautions to prevent identity theft.

-

While these measures significantly reduce risk, 73% of those who have taken precautionary steps still report being targeted by scams at some point. This underscores the need for continued vigilance and adaptation in fraud prevention strategies.

Steps to Take If You Are Scammed

If you realize you have fallen for a scam, staying calm and taking immediate action can help minimize damage. Sarah Foster, Bankrate’s U.S. Economic Analyst, advises victims to take the following steps:

- First Learn What You Need to Know NOW! Visit www.ScamVictimsSupport.org to get started properly, including reporting, and getting support!

- Contact Your Bank: Lock your financial accounts and report any fraudulent transactions as soon as possible. Many banks have fraud protection services that may be able to reverse unauthorized transfers.

- Change Your Passwords: Update your passwords for banking, email, and other sensitive accounts to prevent further unauthorized access.

- Freeze Your Credit: Contact the three major credit bureaus (Experian, Equifax, and TransUnion) to freeze your credit reports, preventing scammers from opening new accounts in your name.

- Report the Fraud: File a report with the Federal Trade Commission (FTC) at ReportFraud.ftc.gov. The more information law enforcement has, the better they can track and prevent future scams.

While these steps can help mitigate the immediate impact of fraud, the best defense is prevention. Knowing the signs of a scam, verifying the legitimacy of any unexpected financial requests, and staying informed about emerging fraud tactics can help keep you safe.

The Need for Continued Education and Awareness

The Bankrate survey underscores the importance of financial literacy and fraud awareness. Even those who have taken multiple precautions can still fall victim to sophisticated scams. Education and proactive fraud prevention measures are crucial in staying ahead of scammers who constantly adapt their tactics.

As scams become more advanced, individuals must be skeptical of too-good-to-be-true offers, unsolicited financial requests, and high-pressure sales tactics. Taking the time to verify financial transactions, monitor accounts, and stay informed about common scams can make a significant difference in protecting your money and personal information.

Moving Forward: Staying Ahead of Scammers

The Bankrate Financial Fraud Survey is a sobering reminder that financial scams are not going away—they are evolving. As fraudsters develop new tactics, it is crucial to stay informed and take proactive measures to safeguard personal and financial information.

Fraud prevention is not just an individual responsibility—banks, businesses, social media platforms, and government agencies must also enhance security measures, enforce regulations, and educate consumers. However, the best defense starts with you. By remaining vigilant, questioning suspicious requests, and staying informed about scam trends, you can significantly reduce the likelihood of falling victim to financial fraud.

The reality is clear: scams are a widespread and growing issue, but knowledge and preparedness remain our strongest weapons in the fight against financial fraud.

Final Thoughts

Financial scams are an unfortunate reality, but knowledge and vigilance can help prevent losses and emotional distress. The findings from Bankrate’s Financial Fraud Survey make it clear that scams are affecting millions of Americans every year, and no one is entirely immune. By staying informed, taking proactive security measures, and recognizing red flags, you can significantly reduce your risk of becoming a victim. Scammers rely on deception and emotional manipulation—arming yourself with knowledge is the most effective way to fight back.

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims.

- SCARS Institute now offers its free, safe, and private Scam Survivor’s Support Community at www.SCARScommunity.org – this is not on a social media platform, it is our own safe & secure platform created by the SCARS Institute especially for scam victims & survivors.

- SCARS Institute now offers a free recovery learning program at www.SCARSeducation.org.

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery.

If you are looking for local trauma counselors, please visit counseling.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

Statement About Victim Blaming

Some of our articles discuss various aspects of victims. This is both about better understanding victims (the science of victimology) and their behaviors and psychology. This helps us to educate victims/survivors about why these crimes happened and not to blame themselves, better develop recovery programs, and help victims avoid scams in the future. At times, this may sound like blaming the victim, but it does not blame scam victims; we are simply explaining the hows and whys of the experience victims have.

These articles, about the Psychology of Scams or Victim Psychology – meaning that all humans have psychological or cognitive characteristics in common that can either be exploited or work against us – help us all to understand the unique challenges victims face before, during, and after scams, fraud, or cybercrimes. These sometimes talk about some of the vulnerabilities the scammers exploit. Victims rarely have control of them or are even aware of them, until something like a scam happens, and then they can learn how their mind works and how to overcome these mechanisms.

Articles like these help victims and others understand these processes and how to help prevent them from being exploited again or to help them recover more easily by understanding their post-scam behaviors. Learn more about the Psychology of Scams at www.ScamPsychology.org

SCARS INSTITUTE RESOURCES:

If You Have Been Victimized By A Scam Or Cybercrime

♦ If you are a victim of scams, go to www.ScamVictimsSupport.org for real knowledge and help

♦ SCARS Institute now offers its free, safe, and private Scam Survivor’s Support Community at www.SCARScommunity.org/register – this is not on a social media platform, it is our own safe & secure platform created by the SCARS Institute especially for scam victims & survivors.

♦ Enroll in SCARS Scam Survivor’s School now at www.SCARSeducation.org

♦ To report criminals, visit https://reporting.AgainstScams.org – we will NEVER give your data to money recovery companies like some do!

♦ Follow us and find our podcasts, webinars, and helpful videos on YouTube: https://www.youtube.com/@RomancescamsNowcom

♦ Learn about the Psychology of Scams at www.ScamPsychology.org

♦ Dig deeper into the reality of scams, fraud, and cybercrime at www.ScamsNOW.com and www.RomanceScamsNOW.com

♦ Scam Survivor’s Stories: www.ScamSurvivorStories.org

♦ For Scam Victim Advocates visit www.ScamVictimsAdvocates.org

♦ See more scammer photos on www.ScammerPhotos.com

You can also find the SCARS Institute’s knowledge and information on Facebook, Instagram, X, LinkedIn, and TruthSocial

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this and other SCARS articles are intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

Note about Mindfulness: Mindfulness practices have the potential to create psychological distress for some individuals. Please consult a mental health professional or experienced meditation instructor for guidance should you encounter difficulties.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here

If you are in crisis, feeling desperate, or in despair, please call 988 or your local crisis hotline – international numbers here.

More ScamsNOW.com Articles

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish. Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors’ experience. You can do Google searches, but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

![NavyLogo@4x-81[1] New Bankrate Survey Shows Scams Increasing - 2025](https://scamsnow.com/wp-content/uploads/2025/04/NavyLogo@4x-811.png)

![scars-institute[1] New Bankrate Survey Shows Scams Increasing - 2025](https://scamsnow.com/wp-content/uploads/2025/04/scars-institute1.png)

![niprc1.png1_-150×1501-1[1] New Bankrate Survey Shows Scams Increasing - 2025](https://scamsnow.com/wp-content/uploads/2025/04/niprc1.png1_-150x1501-11.webp)