Massive Increase in Losses with Bitcoin ATM Scams

New FTC Analysis Shows Crypto ATM Scams Increased Nearly 1,000% to Over $110 Million in 2023

Primary Category: News & Analysis

Author:

• SCARS Editorial Team – Society of Citizens Against Relationship Scams Inc.

• United States Federal Trade Commission (FTC)

About This Article

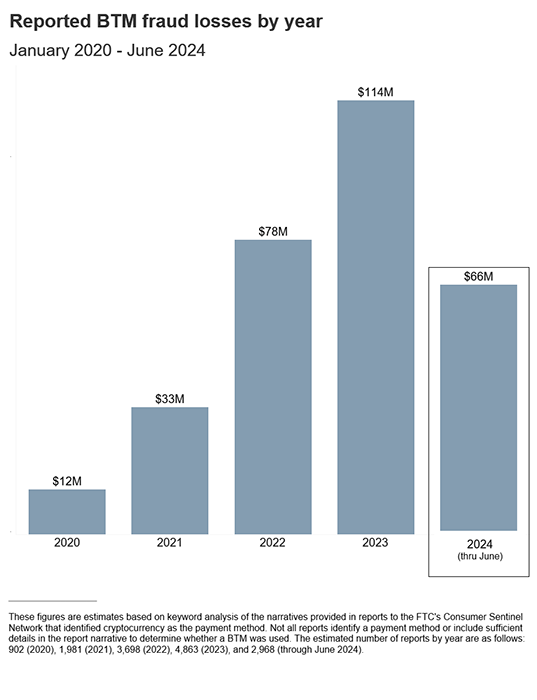

New data from the U.S. Federal Trade Commission (FTC) reveals a dramatic increase in losses due to Bitcoin ATM scams, with consumer reports showing nearly a tenfold rise since 2020, reaching over $110 million in 2023.

The first half of 2024 alone saw losses exceed $65 million, with older adults particularly vulnerable, being three times more likely to report losses than younger individuals.

Scammers commonly use Bitcoin ATMs in schemes involving government impersonation, business impersonation, and tech support scams, urging victims to deposit cash into these machines under false pretenses. This alarming trend underscores the need for increased awareness and caution when dealing with unexpected financial requests involving Bitcoin ATMs.

New U.S. Federal Trade Commission (FTC) Data Shows Massive Increase in Losses to Bitcoin/Cryptocurrency ATM Scams

Reports from consumers show a nearly tenfold increase since 2020 in the amount lost to scammers using Bitcoin ATMs

New data from the Federal Trade Commission shows a massive increase in the amount of money consumers report losing to scammers involving Bitcoin ATM machines. Since 2020, the amount consumers reported losing has increased nearly tenfold to over $110 million in 2023.

Increased nearly 1,000% to over $110 million in 2023

Even More in 2024 – $66 million Year To Date!

Bitcoin ATMs are machines that look like a traditional ATM and are often found at convenience stores, gas stations, and other high-traffic areas. Instead of distributing cash, they accept cash in exchange for cryptocurrency. Their use by scammers, who urge consumers to deposit cash into them to “protect” their savings, is on the rise.

In a newly released data spotlight, the FTC says that fraud losses to Bitcoin ATMs have topped $65 million in just the first six months of 2024. During this timeframe, consumers over the age of 60 were more than three times as likely as younger adults to report losing money to Bitcoin ATM scams. Across all ages, the median loss reported in the first half of this year was a staggering $10,000.

The majority of scam losses involving Bitcoin ATMs come as a result of government impersonation, business impersonation, and tech support scams. The lies told by scammers vary, but they all create some urgent justification for consumers to take cash out of their bank accounts and put it into a Bitcoin ATM. As soon as consumers scan a QR code provided by scammers at the machine, their cash is deposited straight into the scammers’ crypto account.

Bitcoin ATMs: A Payment Portal for Scammers

Bitcoin ATMs (or BTMs) have been popping up at convenience stores, gas stations, and other high-traffic areas for years. For some, they’re a convenient way to buy or send crypto, but for scammers, they’ve become an easy way to steal. FTC Consumer Sentinel Network data show that fraud losses at BTMs are skyrocketing, increasing nearly tenfold from 2020 to 2023, and topping $65 million in just the first half of 2024. Since the vast majority of frauds are not reported, this likely reflects only a fraction of the actual harm.

Cryptocurrency surged as a major payment method for scams in recent years, along with the massive growth in crypto payments on fake investment opportunities. But now crypto is a top payment method for many other scams, too. Widespread access to BTMs has helped make this possible. Reports of losses using BTMs are overwhelmingly about government impersonation, business impersonation, and tech support scams. And when people used BTMs, their reported losses are exceptionally high.

In the first six months of 2024, the median loss people reported was $10,000.

–

–

In the first half of the year, people 60 and over were more than three times as likely as younger adults to report a loss using a BTM. In fact, more than two of every three dollars reported lost to fraud using these machines was lost by an older adult.

Scams that use BTMs work in lots of different ways. Many start with a call or message about supposed suspicious activity or unauthorized charges on an account. Others get your attention with a fake security warning on your computer, often impersonating a company like Microsoft or Apple. These things are hard to ignore, and that’s the point. From there, the story quickly escalates. They might say all your money is at risk, or your information has been linked to money laundering or even drug smuggling. The scammer may get a fake government agent on the line – maybe even claiming to be from the “FTC” – to up the ante.

So where do BTMs fit into the story? Scammers claim that depositing cash into these machines will protect your money or fix the fake problem they’ve concocted. They’ve even called BTMs “safety lockers.” They direct you to go to your bank to take out cash. Next, they send you to a nearby BTM location – often a specific one – to deposit the cash you just took out of your bank account. They text you a QR code to scan at the machine, and once you do, the cash you deposit goes right into the scammer’s wallet.

How Can You Spot and Avoid These Scams?

- Never click on links or respond directly to unexpected calls, messages, or computer pop-ups. If you think it could be legit, contact the company or agency, but look up their number or website yourself. Don’t use the one the caller or message gave you.

- Slow down. Scammers want to rush you, so stop and check it out. Before you do anything else, talk with someone you trust.

- Never withdraw cash in response to an unexpected call or message. Only scammers will tell you to do that.

- Don’t believe anyone who says you need to use a Bitcoin ATM, buy gift cards, or move money to protect it or fix a problem. Real businesses and government agencies will never do that – and anyone who asks is a scammer.

Please Rate This Article

Please Leave Us Your Comment

Also, tell us of any topics we might have missed.

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment above!

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment above!

ARTICLE RATING

TABLE OF CONTENTS

CATEGORIES

MOST POPULAR COMMENTED ARTICLES

POPULAR ARTICLES

U.S. & Canada Suicide Lifeline 988

![NavyLogo@4x-81[1]](https://scamsnow.com/wp-content/uploads/2025/04/NavyLogo@4x-811.png)

ARTICLE META

WHAT PEOPLE ARE TALKING ABOUT LATEST SITE COMMENTS

See Comments for this Article at the Bottom of the Page

on Arts and Crafts Can Significantly Aid in Recovery for Scam Victims – 2025: “I did not realize that things I like doing very much—knitting or sudoku—were so helpful in my recovery process. The…” Jul 14, 11:28

on Projection And Scam Victims: “The moment I realized I had a financial loss due to a scam I realized that I felt shame, guilt,…” Jul 13, 19:12

on Japanese Legend of Tears – When There Are No Words – 2025: “After discovering the fraud, the pain was enormous. I shed oceans of tears, but I always tried to do it…” Jul 13, 10:50

on The SCARS Institute Scam Victim Recovery Timeline – 2025: “Wow. I umm experienced some of the later curves. I have been bouncing back and forth between asking myself why…” Jul 11, 00:01

on Transference And Emotional Danger After The Scam – 2024: “Thank you for the kind but firm reminder that the person in the stolen profile photo has their own life.…” Jul 9, 01:26

on ‘Mental Defeat’ – The Unique Condition Of Giving Up – 2024: “Thank you for another great article. I can see from this article that mental defeat would be debilitating to a…” Jul 9, 00:49

on Trust: Romance Scams Betrayal And Scam Victims – 2024: “This provided valuable insight that I can identify with” Jul 8, 16:44

on A Scam Victim in Extreme Distress – Stopping the Pain – 2024: “Your trust issues are very understandable. We are very sorry this happened to you. We suggest that you contact an…” Jul 8, 14:42

on A Scam Victim in Extreme Distress – Stopping the Pain – 2024: “My online counselors advised me to check myself in. I went to the hospital because I was suicidal. After I…” Jul 8, 13:44

on Scam Victim Catastrophizing Making Recovery Difficult 2024: “Excellent article on catastrophizing. I can understand how this could take a person down a rabbit warren of never ending…” Jul 8, 12:12

on The Self-Pity Trap & How To Overcome It – 2023 – [UPDATED 2025]: “I am not in the habit of feeling sorry for myself. After the deception, although it was not easy at…” Jul 8, 11:49

on Pride – A Dual Edged Sword For Scam Victims – 2023 [UPDATD 2024]: “Looking back over my life I have seen how pride has impacted me both positively and negatively. However the negative…” Jul 8, 09:08

on The Self-Pity Trap & How To Overcome It – 2023 – [UPDATED 2025]: “I felt self-pity while the enormity of my financial loss washed over me like a tsunami. The self-pity lasted only…” Jul 7, 18:55

on The Uniqueness Of Scam Victims Or Fraud Victims – 2024: “unfortunately all true. It is highly stressful dealing with the aftermath. I am being sued for the money I borrowed…” Jul 6, 12:50

on Scam Victims & Mental Health Blaming – 2023 [UPDATED 2025]: “For most of my life words have defeated me, made me feel insignificant, unwanted, unneeded. For this reason it is…” Jul 5, 13:36

on Substance Abuse Susceptibility And Scam Victims – 2024: “It is understandable how some would feel that alcohol or substance abuse would be helpful in handling their feelings after…” Jul 1, 20:36

on Scam Victims Use Work To Avoid Healing: “The last 6 years have been the most difficult of my life. The pandemic, having both parents in the hospital…” Jun 29, 18:38

on Entitlement Mentality And How Scam Victims Often Lose Their Path To Recovery – 2024: “Thank you for this discussion of entitlement. I can see from the descriptions listed that I have not felt entitlement.…” Jun 29, 18:22

on Samurai Wisdom and Rituals for Clearing the Mind After Scam Trauma – 2025 – [VIDEOS]: “A great guide on how to move forward in our recovery process with a calm mind, cleansed on an ongoing…” Jun 28, 07:34

Important Information for New Scam Victims

Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

SCARS Institute now offers a free recovery program at www.SCARSeducation.org

Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors, please visit counseling.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

Statement About Victim Blaming

Some of our articles discuss various aspects of victims. This is both about better understanding victims (the science of victimology) and their behaviors and psychology. This helps us to educate victims/survivors about why these crimes happened and not to blame themselves, better develop recovery programs, and help victims avoid scams in the future. At times, this may sound like blaming the victim, but it does not blame scam victims; we are simply explaining the hows and whys of the experience victims have.

These articles, about the Psychology of Scams or Victim Psychology – meaning that all humans have psychological or cognitive characteristics in common that can either be exploited or work against us – help us all to understand the unique challenges victims face before, during, and after scams, fraud, or cybercrimes. These sometimes talk about some of the vulnerabilities the scammers exploit. Victims rarely have control of them or are even aware of them, until something like a scam happens, and then they can learn how their mind works and how to overcome these mechanisms.

Articles like these help victims and others understand these processes and how to help prevent them from being exploited again or to help them recover more easily by understanding their post-scam behaviors. Learn more about the Psychology of Scams at www.ScamPsychology.org

SCARS INSTITUTE RESOURCES:

If You Have Been Victimized By A Scam Or Cybercrime

♦ If you are a victim of scams, go to www.ScamVictimsSupport.org for real knowledge and help

♦ Enroll in SCARS Scam Survivor’s School now at www.SCARSeducation.org

♦ To report criminals, visit https://reporting.AgainstScams.org – we will NEVER give your data to money recovery companies like some do!

♦ Follow us and find our podcasts, webinars, and helpful videos on YouTube: https://www.youtube.com/@RomancescamsNowcom

♦ Learn about the Psychology of Scams at www.ScamPsychology.org

♦ Dig deeper into the reality of scams, fraud, and cybercrime at www.ScamsNOW.com and www.RomanceScamsNOW.com

♦ Scam Survivor’s Stories: www.ScamSurvivorStories.org

♦ For Scam Victim Advocates visit www.ScamVictimsAdvocates.org

♦ See more scammer photos on www.ScammerPhotos.com

You can also find the SCARS Institute on Facebook, Instagram, X, LinkedIn, and TruthSocial

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this and other SCARS articles are intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

Note about Mindfulness: Mindfulness practices have the potential to create psychological distress for some individuals. Please consult a mental health professional or experienced meditation instructor for guidance should you encounter difficulties.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here

If you are in crisis, feeling desperate, or in despair, please call 988 or your local crisis hotline.

More ScamsNOW.com Articles

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish. Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors’ experience. You can do Google searches, but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

![scars-institute[1]](https://scamsnow.com/wp-content/uploads/2025/04/scars-institute1.png)

![niprc1.png1_-150×1501-1[1]](https://scamsnow.com/wp-content/uploads/2025/04/niprc1.png1_-150x1501-11.webp)

Leave a Reply